I noted a new report from the Resolution Foundation on Monday. In that report, that think tank suggested that maybe 30% of all households in the UK had savings of less than £1,000 available to them. The solution that the Resolution Foundation suggested was, quite extraordinarily, that those households should be forced to save more. They appeared to never consider the possibility that the reason why these households have such low savings is that they already have almost no capacity to save because their costs of living absorb all their available earnings.

Standing back, there is a particularly perverse aspect to this recommendation. Only a few months ago, I highlighted another perverse report from the Resolution Foundation in which they suggested that the government should run surpluses in most years. This, they suggested, would then provide the government with the capacity to run deficits if they might ever be required. In the process, they revealed a complete lack of understanding of macroeconomics. They obviously think this to be similar to the economics of a household. Nothing could be further from the truth. Governments can create money to manage deficit spending, but households cannot. This straightforward fact was either not known to or was assumed away by the Resolution Foundation. What they did, however, also reveal was their lack of awareness of one of the most basic analytical tools within macroeconomics, which is sectoral balance analysis.

Sectoral balance analysis assumes that the economy is made up of just four sectors. These are:

- The household sector

- The corporate sector

- The government sector

- The overseas sector, i.e. the transactions that those normally resident outside the UK undertake in sterling.

Sectoral balances in an economy like that within the UK seek to highlight the net savings and borrowings that take place between the sectors.

The assumption implicit in this analysis is quite straightforward. It is assumed that if some sectors are in surplus in a period, meaning that they save, then it must follow that other sectors must be in deficit, i.e. they borrow. This is the necessary consequence of the infallible logic implicit within double-entry bookkeeping, which is that every action has a reaction, requiring as a result that any saver must, by definition, create a borrower, even if that is only a bank.

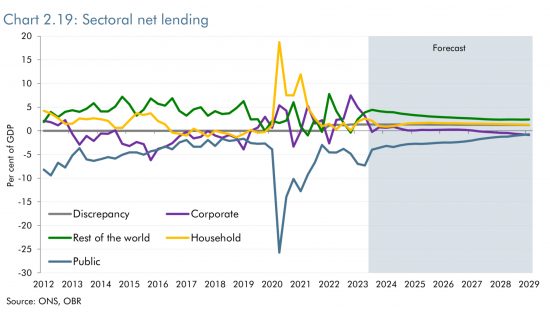

The evidence of recent years is that households are not very good at saving, except during the Covid crisis. By and large, they also seem to have spent the money they saved then. The latest forecast for the sectoral balances, as prepared in November 2023 by the Office for Budget Responsibility, as noted below, shows that they do not forecast any change to the modest net savings now made by households for some time to come.

I also note from that forecast that the OBR does not expect the corporate sector to borrow for some time to come, and then, when it does, it will do so only very modestly. Candidly, I think that an optimistic projection by the OBR: given the stagnant UK economy that is forecast for years to come there is no reason for business to invest much.

It would also seem that the Office for Budget Responsibility is, as ever, wildly optimistic about the probability that the government will cut its borrowing over coming years. This is a consistent feature of their forecasts, almost all of which have always been decidedly over-optimistic in this regard.

If, however, as they do forecast, the government does cut its borrowing, and given that neither households nor businesses are much inclined to borrow, the inevitable net consequence is that the overseas sector must, in net terms, save less in the UK than it has done for a long time. This might happen, with Brexit finally creating this consequence, but there is no evidence as yet to suggest that this is likely.

Then, though, let me presume that what the Resolution Foundation wants occurs and that households save more and the government moves into surplus, as they would like, whilst the corporate sector remains broadly neutral. With those three sectors all then moving into positive territory the inevitable requirement would be that the overseas sector would then have to borrow sterling rather than save in it, as has been its accustomed behaviour.

I accept that this might be a consequence of the government borrowing less when much of the overseas sector is saved in gilts. That, though, seems unlikely. There are, after all, very many good reasons why overseas governments do want to hold sterling reserves, not least to support trade but also as part of the balances that underpin the IMF's special drawing rights and other reserve balances. The UK also remains an attractive place for many to save, given the relative financial stability that it still supplies for some who require it. In summary, I simply cannot see the overseas sector moving into negative territory, which, as the chart shows, would be exceptionally unusual in the current era.

In that case, does the Resolution Foundation's suggestion that both households and the government should save more make any sense at all? The obvious answer is that it does not.

Think tanks are very good at suggesting that governments should do joined-up thinking. It looks to me as though the Resolution Foundation might need to do the same. It might also need to sharpen up its understanding of macroeconomics. It might be a little more credible if it did so.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

To be honest, to me at least they seem to confuse macro with micro all the time – Steve Keen spotted this fault in neoliberalism some time ago. They are not credible IMHO.

For whom was the report written (or who funded it?).

Who in the Resolution Foundation did most of the writing and why did it not occur to them that one possibility is that, as noted, large numbers of households are living on the edge/day to day.

Did the foundation ask for an outside critique?

Given the track record, it would seem the Resolution Foundations motto can only be: “resolutely wrong”.

If I was funding ’em, I’d want my money back. & it shows the deep disfunction within the UK and its institutions.

The inability of the British to do “joined-up thinking” is clearly its bane. This is very obvious from the continued support of a Starmer led Labour Party which is still regarded by many as a progressive party despite of (or because of his mindless) belief the UK government operates on a credit card. This belief stems from not understanding four things.

Firstly, the so-called “independent” Bank of England is actually part of the UK government.

Secondly, as part of the UK government it can create money digitally from thin air.

Thirdly, because of this power the UK government doesn’t need to borrow from the private sector to fund its spending or stimulate investment.

Fourthly, there cannot be a situation where one part owes money to another part such as the UK government to its own bank.

The source of this lack of “joined-up thinking” has to come from those who teach economics at our universities. For too long we haven’t made this academic discipline accountable. How can this be done more effectively?

https://www.bankofengland.co.uk/monetary-policy/quantitative-easing

The Treasury does operate with a credit card, it is called The National Loans Fund (NLF); and its job is to fund the deficit in The Consolidated Fund at the end of the financial year. It has, theoretically, an infinite credit limit. The balance on the card hasn’t been paid off for years. See page 7 of https://assets.publishing.service.gov.uk/media/653a25abe6c968000daa9b36/Consolidated_Fund_Account_2022-23.pdf

The National Loans Fund (alias, the Magic Money Tree) https://assets.publishing.service.gov.uk/media/653a26b6e6c968000daa9b37/National_Loans_Fund_Account_2022-23.pdf Have a look at its assets and liabilities on page 8. All the Gilt issues are its liability. Neither Gilts nor Taxes directly fund government spending. Every Pound the government spends is brand new every day. Gilts remove the amount of currency in circulation temporarily; Taxes remove the permanently.

If the government created and spent £100 billion extra currency units to build HS2 for instance, those currency units would end up as deposits in Bank accounts. If spent by individuals, they could create inflation. The government would have to arrange taking those deposits out of circulation by selling tickets with VAT and taxing profits.

I need to send some time on these and have not found it.

Thanks for highlighting them.

I think they confuse “Saving” with “Investment”. (You pointed this out in a BTL comment the other day).

Investment is important, usually good and severely lacking in this country. However, this does not mean we all need to save more in order to make this investment to happen.

Why do/should people need a greater level of precautionary savings? Beyond a few pounds to meet unexpected bills, these precautionary savings are there because of the precarious nature of many people’s economic life. Improve sick pay, unemployment benefits, redundancy pay etc.. and the need to savings virtually disappears.

The economist George Shackle pioneered “Uncertainty Theory” in opposition to the current dominant “Probability Theory”:-

https://en.wikipedia.org/wiki/G._L._S._Shackle

It could be said that Keynes’s/Shackle’s “Uncertainty Theory” is the basis of Abby Innes’s book “Late Soviet Britain.”

Thank you, I had not heard of him. Every day is a school day on this blog!

A non-equilibrium model sounds like an application for quantum computing.

But how that translates to household v overseas sectoral balance i dont know.

It looks like forward projections are quantum as a figment of imagination or “will” in the policy think tanks melancholia.

These thought process are not yet captured by any model.

People save because you can never be certain that you won’t face a large unexpected bill (e.g. car repair). Many also save shortish-term for a planned expense (holiday, house improvements, etc.). These can be substantial amounts of money, well in excess of £1,000. Although a lot of people probably borrow to pay for such things, I’m sure many prefer to have the savings first. It would be interesting to know the ratio.

But surely the biggest reason for long-term savings is retirement pensions, or is that accounted for separately?

I think we need to differentiate pensions from all other savings

I am niot saying peoole do not need to save

I am saying that a great deal of saving does not need state subsidy

“households should be forced to save more”

Ridiculous, of course we’d all save more if we could. The comment is unbelievably out of touch with reality, and how people live. I can think of many better alternatives, government should be forced to

✅Ensure that public sector wages keep up with inflation.

✅That they keep energy costs within inflation

✅That inequality does not increase

I’ve often wondered why public sector pay isn’t just index linked. It would practically eliminate strike action and would be fair and transparent to new public sector workers joining the workforce.

Public sector pay isn’t index linked, Ben, because that would stop governments from cutting it. Tories, who don’t value public provision, always want to cut it even when they don’t say so.

Having read this I was listening to Steve Keen’s latest podcast (Debunking Economics) followed by Pitchfork Economics talking about Bidens policies. Combine them with the Cowboy Economist and you’d have a better understanding of how today’s economy works and what needs doing than Reeves and the rest of the orthodox cult will ever have.

A cult … or maybe the world’s most damaging conspiracy theory. Disastrous economically, socially and environmentally. But like conspiracy theories, it does not respond to rational analysis and debate.

The idea that households and governments should all save is economics pre Keynes!