According to the Office for National Statistics this morning:

- The Consumer Prices Index (CPI) rose by 6.7% in the 12 months to August 2023, down from 6.8% in July.

- On a monthly basis, CPI rose by 0.3% in August 2023, compared with a rise of 0.5% in August 2022.

- The largest downward contributions to the monthly change in CPI annual rates came from food, where prices rose by less in August 2023 than a year ago, and accommodation services, where prices can be volatile and fell in August 2023.

- Rising prices for motor fuel led to the largest upward contribution to the change in the annual rates.

- Core CPI (excluding energy, food, alcohol and tobacco) rose by 6.2% in the 12 months to August 2023, down from 6.9% in July; the CPI goods annual rate rose slightly from 6.1% to 6.3%, while the CPI services annual rate slowed from 7.4% to 6.8%.

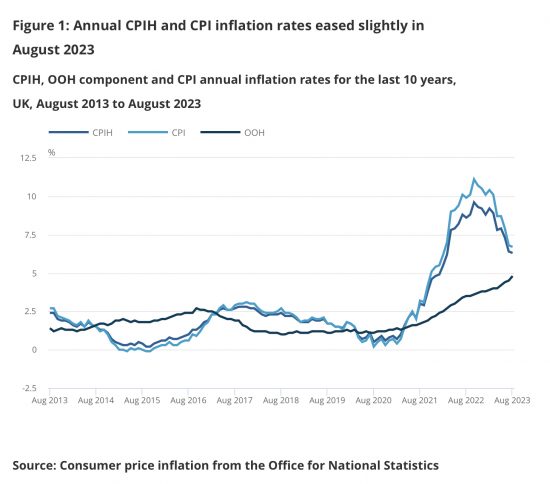

There had been a great deal of speculation about inflation taking an upward turn this month as a result of rising road fuel costs. Other factors overwhelmed them and the fall in inflation continued instead. The downward trend, which I long predicted, is now very obvious:

CPI is the only really important measure noted in the chart.

So, what now?

First, this gives the Tories a small boost: that is inevitable. It does not disguise their otherwise disastrous performance, but they will claim credit for this.

Second, as should be obvious, the need now is for interest rates to fall given that they are now one of the biggest causes of remaining inflation. That, however, is very unlikely: the Bank of England remains dedicated to a programme of high interest rates and I still expect a rate rise this week.

Third, those who have lost out on pay need to have above inflation pay rises now or purchasing power is going to be permanently impaired by this inflation, creating long term impacts which will otherwise take years to eliminate, if they ever are.

Of these three only the first is likely. The other two are unlikely. It seems much more likely that it is the combined Tory/Labour/Bank of England plan to ensure that the upward redistribution of income resulting from this inflationary period will survive in the long term. Why they would wish for that, except to appease the media, is hard to tell. But this would seem to be their plan now and it is profoundly unjust.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Might they seek to retain and gain big donors?

Yes

Hunt has already come out of his hole to say that ‘the plan’ is working. I heard him and Sunak talking about this ‘plan’ for months now. It probably fits on a post it note and says: sit tight and mention the plan.

I notice that ‘everyone’ seems to be surprised by this result. At least they are according to the BBC. If the Bank of England is surprised, isn’t it time that someone pointed out their complete lack of economic understanding?

‘lack of Economic understanding’ – there is no lack of economic understanding as far as the economics of party funding is concerned I can tell you that.

Trickle down basically still exists but the only trickle is from the rich to the political class and this is what we are seeing in plain sight.

The Bank of England is wedded to the New Keyensian DSGE model which, as Bill Mitchell often says is no more than GIGO – garbage in – garbage out. I wouldn’t be at all surprised if Bailey and his fellow travellers are also firm believers in the Quantity Theory of Money which even the old fraud Friedman agreed was horseshit toward then end of his days.

(As an aside both Richard and Bill have been wholly consistent in their analysis of the current inflaitonary period and both are being proven correct).

Back to the media and it is the lack of challenge to obviously incorrect assertions from politicians that gets me the most – just yesterday in a peice on the slow burning disaster of local government finance a piece on Medway council in Kent had an unachallenged statement by the former Tory council leader that the Labour administration who inherited their mess couldn’t claim inflation as a problem as this is now falling. This lack of understanding of inflation as a rate of change is widespread yet so simple to counter. If a thing cost £100 in 2021 and in 2022 inflation was 10% then in 2022 it would cost £110. If in 2023 inflation then falls to 7% that does not mean the price has fallen – in 2023 it will now cost £117.70 – a simple fact that seems beyond our media and politicians

Thanks

The comic absurdity of this, is that Rishi Sunak will claim that the fall in inflation is all his doing; or to put it another way, he will take the credit for a fall that was a consequence of the same forces that caused inflation in the first place; to use the comic jargon of economists exogenous forces over which Rishi Sunak has precisely no control whatsoever. Rishi Sunak has been nothing more than a forlorn face, pressed against the window of history. He is, so so typically of him – taking credit for doing absolutely nothing; in fact his contribution has been to make things far worse, but that is a loss that (fortunately for him, only because nobody is auditing his decisions closely enough); in the greater sweep of forces at work his blunders are conveniently hidden or lost by everyone’s inattention; or they would finally recognise that Sunak’s participation is never going to be as more than a mere extra, part of the casually helpless flotsam of the drama life.

My spell-checker now keeps trying to correct my spelling of his name to ‘Rich Sunk’; how apt.

It seems to me that there is major cognitive dissonance from government, opposition and media in that the ‘independent’ Bank of England is tasked with controlling inflation – but now Sunak has taken on the project of ‘halving inflation’ with his (do nothing) ‘PLAN’.

So why has Sunak entrusted his own government with something the BoE is supposed to be doing?

Shouldn’t there be consequences for the BoE’s failure?

At the very least shouldn’t it be obvious that the BoE’s task is one of which it is incapable?

Good point…

From the Green Jobs Alliance.

“With the impact and urgency of the climate crisis increasingly evident, we are

nevertheless seeing a conscious backsliding of climate commitments on the part of

the UK government.

We are no longer standing on one of Boris Johnson’s delusionary pyramids of

patriotic piffle about the UK “leading the world”, but are told that we will “achieve

net zero” in a “pragmatic” and “proportionate” way. In other words, at a pace that is

comfortable for fossil fuel companies like Shell; working, as it is, on a timescale for

Net Zero that’s between fifty and a hundred years too late.

So, the Climate Change Committee’s very clear call for no further airport expansion

is ignored on the grounds that the immediate benefits outweigh the inevitable

consequences.

This goes with the flow of corporate pressure (and lobby donations) and is as tawdry as that.

This is posed in all too much of our media as a brave thing to do – “Sunak defies

Net Zero ban” (Daily Telegraph). An eleventh century version of the Telegraph would

probably have run with “Cnut defies waves”. But King Cnut knew he couldn’t; that

the laws of nature are stronger than the will of Kings. Or Prime Ministers. Rishi

Sunak doesn’t seem to.”

I love the idea os Sunak being compared to Cnut, except that Cnut knew he couldn’t defy the waves.

The BBC is reporting that “UK inflation: Slowing food prices drive surprise fall” (20 Sep 2023) https://www.bbc.co.uk/news/business-66844295

Which also ignores all the other factors that affect inflation, in particular the huge energy price increase spike that is slowly being factored out of the 12-month inflation calculations.

Of course the Tories will claim credit for the decrease in inflation, although in reality, it has fallen in spite of their policies, not because of it.