In the debate I was involved in on Nicky Campbell's show on Radio 5 Live and the BBC News Channel this morning, it was claimed by one financial services person who phoned in that the era of low-interest rates is over and that high and oil and gas prices are here to stay so, of course, we are going to be poorer as Huw Pill from the Bank of England forecast.

So, here is the 10 year chart of Brent Oil prices per barrel:

And this is European natural gas:

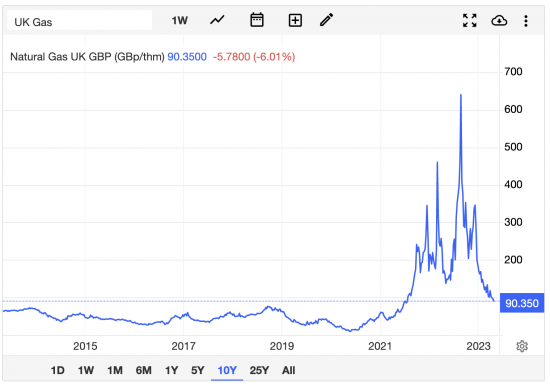

And this is UK natural gas:

There are, of course, differences.

But there is also one massive thing in common: all these prices are tumbling from the highs to which speculators and not the cost of production took them.

So, what caused this boom in prices? Greedfalation, of course.

And why aren't all the benefits of tumbling prices (with very obviously more to come) flowing through as yet? The same answer, of course.

Will all prices go back to where they were? I can't be sure. But oil is already moving there. Gas is likely to fall somewhat more.

For anyone to claim in that case that we must be poorer for this reason is wrong. We need to allow wages to adjust to what has happened. And then we need to move on. But a perpetual adjustment in profits in an upward direction cannot be justified by what is happening in oil and gas prices. Those claiming otherwise are wrong, as I noted during the programme.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Well said!

Those trends also look like they could fall further.

I have serious doubts though that the privatised gas and electricity companies will pass on all the benefit of these falls. I also suspect that they will keep their standing charges high as well, as they rarely ever lower them. They will probably use the fall in prices in the market to fill their boots and raise profits again. I expect the National Grid to beat its one billion of profit from last year.

One things for sure, the Tories will do nothing to ensure that they pass on the full benefit to the rest of us, but they will take credit for whatever price fall is passed on.

“Passing on the benefits” is an interesting phrase – let’s try the following: as we know the nice USA has stepped into the breach and is supplying Europe (and doubtless the Uk) with gas. Henry Hub gas prices are +/- $3.77/MWh. Dutch TTF prices are around Euro35/MWh. BP, Shell et al now have a nice little number running, moving US gas to Europe (doubtless the Americans are wetting themselves with laughter). “The carry trade” – buy cheap – sell expensive, trouser the difference.

Both the EU and Uk are being taken to the cleaners by the large fossil fuel companies. As for the Tories, follow the numbers, they are funded by the oil n gas mafia – why would they change anything? & for the avoidance of doubt – North Sea gas costs around $1- 2/MWh to extract. Sadly, the press never discusses this. Indeed why would they given for the most part they are both innumerate and uncurious.

A new sub-glossary could be created to describe all manners of consumer exploitation, this is another I’ve just found… I’m sure your followers could be creative and come up with more….

INVESTING EXPLAINED: What you need to know about ‘excuseflation’ – the ploy to hike prices that looks a lot like ‘greedflation’

‘What kind of excuses are used?

The list of excuses given over the past couple of years includes bird flu, blockages in the Suez canal, Covid, higher transports overheads, supply chain issues and war in Ukraine. These may be entirely legitimate reasons to raise prices but the companies engaging in excuseflation are seen as exploiting the situation.

How do companies go about this?

They start increasing prices by degrees, watching to see whether customers grin and bear it, or depart for rival cheaper brands. Some products, particularly foodstuffs, have a dedicated fan-base who will economise in other areas to afford their favourite indulgence.

Sales may be sacrificed in favour of the fatter profit margins that can be produced by the strategy. The company may also wish to attract a more affluent clientele who are less concerned about making ends meet.

https://www.thisismoney.co.uk/money/investing/article-11899877/What-Excuseflation-Investing-Explained.html

Very good

I must get back to the glossary….

On which subject… in the glossary there seems to be nothing on revenue – an indication after all, that money comes back…

This might be important in MMT/Tax discussions..

UK taxes are collected after all, by HM Revenue & C!

And also why we actually complete a tax RETURN and not say, simply a tax declaration.

The old terminology is distinctly demonstrative, but actually has been lost in the modern world.

Noted Peter

Have you written anything on this?

This shows the problem with the MSM. It’s like presenters, journalists and background staff have never heard of the internet. I’ve checked those prices online myself recently and it took no time to find what I was looking for. To allow someone to say something so obviously wrong without correcting it when it’s an easy to check fact is just lazy. They didn’t even need the person on, since the interpretation is obviously greed and a failed system, unless of course your agenda is propaganda.

Mr Willetts, “greed and a failed system” is a much better description of the problem and it’s causes than anything Huw Pill or Rupert Harrison are ever going to find to explain away the mess we find ourselves in, or by listening to their intellectually moribund, self-serving apologetics.

Wholeheartedly agreed.

Huw Pill is just so detached from reality.

I was in Asda yesterday and bought some savers brand tinned peaches at 35 p per can . They tasted exactly the same as the (Delmonte) brand at

£1per can. However the supply of the cheap brand was very restricted and on the bottom shelf -blink ones eye and you miss it. Supply restriction increases brand penetration. Judicious shopping is possible but hard work. Consumers need a trusted benchmark a la NS& I. Non sequitur but a state owned energy company needs to set the benchmark for standards and consumer pricing. If some of the private utilities go bust or are bought up at a much reduced share price as a result then that will be a consequence of a democratic decision

Once again 1997 was the year that so much could have been done that would have changed life in the UK to make the reality of present day UK just a bad dream/nightmare.

The other day I was watching an interview with Tony the Liar, Bill Clinton and Bertie Ahern – the Good Friday Agreement. Whilst Clinton and Ahern looked exactly as you would expect two old men to be the Liar looked like he had stepped out of the makeup room on a film set about the Devil – he looked exactly like a cartoon evil character. If he and Gordon Gekko were to be questioned – if you could go back and change what you did or didn’t do, would you change anything? I think the answer would be no.

Taking back into State control at sensible/non market prices all those industries that were sold at knock down

rip-off prices, wiping out the BTL scum, putting capital gains taxes on all property transactions and properly regulating all the foreign oil and gas companies in the North sea would mean a totally different country today and I wouldn’t have left to live in a country whose elite have to be careful in controlling their greed.

Hi Richard,

I saw a conversation with Huw Pill who seems intent on breaking inflation by holding down wages, I was pretty shocked to hear it straight from the horse’s mouth that plainly. And totally unchallenged: does he realise that in countries like Luxembourg, wages are automatically indexed to inflation. There is no wage price spiral!!!

Thanks

He clearly wants to ignore the evidence that there is no wage price spiral

Hence my claim that there is a conspiracy

Wage – price spiral is much much discredited. BBC news 24 gave a few minutes one morning at 10am to a economics lecturer who tried to squeeze in how it may have had an effect when people demanded 20% rises in the late 1970s. These days is pure ‘price-gouging’.

I’ve written a little on the tax return – though you probably ought to note that it was not well received by the commentators!

http://www.progressivepulse.org/economics/why-it-is-called-a-tax-return

I tend to agree with your two commentators as well

I’m very happy to have found a place on the internet that’s inhabited by decent people with enhanced critical thinking skills.

These conversations, however, are far too complicated for social settings (ok, the pub…) as most people simply file these subjects under “too difficult” or brand the ideas as conspiracy theory.

The frogs appear quite happy to be slowly heated to boiling point whilst the football, Strictly and the msm take their minds off it.

It’s a real factor in British society of low civil disobedience, unlike France which the media politely ignore. Whole sale energy prices are back to normal but still paying through the nose. For many people a real terms pay cut of 40% over the last decade is normal.

I rent a detached 3 bedroom house with internal garage and a big garden in a quiet neighbourhood, it’s actually called les Calmettes. Shopping – 3 supermarkets in walking distance, transport, trains and RN/motorway to Toulouse and International airport 40 minutes away, great walking GR36 to Albi, very friendly neighbours, a shock, 1 burglary in 14 years in the next road 2 years ago. For something similar in Brighton & Hove – burglaries (normal) rapes almost everyday, violence by day and night (normal) murders (common) £30K+ p.a

I was paying €645 p.m – it’s going up €15 p.m. I’m going to look at a piece of land in the same commune – 800 sq. ms @ €28K, with a positive CU – certificate urbanisation/permission to build. I look at land for sale anywhere in the UK, crappy little plots from £120K in the back of beyond. In the SE from £250K – £500K.

Why do I never see aggressive demonstrations for realistic rent controls like most of Europe have. The cheapest house in Brighton & Hove (where I used to live) ex council house, midget 2 bedroom, a handkerchief sized garden, no garage @ £330K -just how long are you going to stand for this on the island?