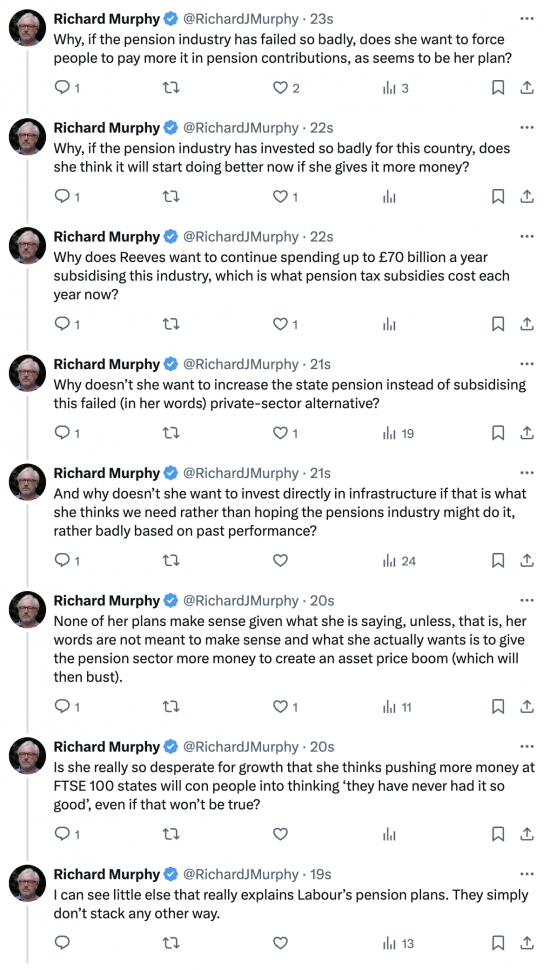

I just posted this thread on Twitter:

I am not sure what else there is to say about today's massively confusing commentary from Rachel Reeves. I would love to find some sense in it. I cannot.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

The answer is hubris mixed with familiarity.

Reeves thinks that she has cut a deal with her old mates in the finance sector and that they are going to help for the sake of ‘Britain’.

New Labour did the same when they talked about being relaxed about people becoming rich, as long as they paid their taxes.

Well, we now know that richer people did not always pay their taxes and that they also were pretty lax when it came to assessing risk when becoming rich. That’s how we got 2008 and all that.

As many of you have pointed out here, Labour will be stabbed in the back by the finance sector again. It’s just a matter of time.

Agreed

And it won’t be long

This is what is so frustrating about Labour and why I had to pipe up.

They just do not learn. It’s stupid.

If you go back to BEFORE Blair, you have them bowing and scraping concessions to the IMF but even worse is what happened under the Wilson government as told by Adam Curtis in his documentary ‘The Mayfair Set’.

Wilson/Labour – entranced by the ‘white heat of technology’ – thought that all those foreign and home grown carpet baggers and asset strippers came into the country to enhance British industry and make it more efficient.

This is what it looked like to begin with, but this was only because company reporting was reporting the sale of their assets. The companies were actually eating themselves alive whilst under ‘new management’. Once all the assets were sold off, ‘performance’ tailed off and it was the government left holding the bag with redundant workers, benefits to be paid and the loss of tax from earnings/Ni contributions and balance of payments problems.

All of that started to erode the basis of the post war Britain, the welfare state, unions, social security – you name it.

Under a Labour government this was realised.

And they’re at it again, kidding themselves that you can go for a walk in the park with a tiger (finance) on a short leash. Except that when you’ve finished walking though park, only the tiger will emerge. Any Satyajit Das book will tell you how finance works, and how the cards are stacked and they’re widely available.

‘The Labour Party’ eh. A pure misnomer. I’ve not voted for them since they ended my final salary pension 2003, and then gave tax breaks to the private pension industry. Since when did a ‘Labour’ movement take money off working people?

It shouldn’t.

End of.

Much to agree with

Hello Pilgrim SR.

Nice to have you back. You have been missed.

“As long as they pay their taxes”

Not just ignored and forgotten but as if it never existed, we are still being told we cannot tax the wealthy and cannot afford to do all sorts of stuff.

We could do a list of corollaries that are ignored, here is another

“it being clearly understood that nothing shall be done which may prejudice the civil and religious rights of existing non-Jewish communities in Palestine”

Any more come to mind?

The skeleton of your headline is evergreen:

If the sector with heavy government intervention has failed the UK why does the Chancellor of the day want to give it more money?

It’s like the person with the perfect gambling system messaging home from Monte Carlo, “System going well, please send more money to fund my next staking pot”.

A caring and thinking person has to only look at what happened to private pension pots in the immediate aftermath of the 2007/2008 GFC to realise that Rachel Reeves is low on critical thinking skills and not very caring either about people who reach retirement age. No doubt her boss has very good civil service pensions not to worry too much either!

Dear Rachel,

I have some niggles with your pension pot plans.

I thought that private companies just needed the ” economic right culture” to succeed.

If the private sector is so good why does the financial services sector need a UK public subsidy of £79bn a year to succeed?

Would it not be better to restrict the charges that the financial sector will charge, seriously increase the percentage that companies contribute to employee pensions?

I do not see how a possible increase in a personal pension pot of up to £11k is seen as a big number.

Sorry, but how are the workers going to increase pension contributions unless they get rather large pay rises?

Somehow I don’t think that the Bank of England and the City will approve of pay rises.

I maybe wrong but the City has never been interested in infrastructure unless they get a guaranteed return, which means that the UK State is on the hook.

Finger crossed.

I have a feeling that the City will celebrate Reeves, seeing in her another Thatcher, one who readily can be conned into unleashing their most base behaviours. We should probably prepare for Big Bang 2 with the same eventual consequences too.

Will Hutton is predicting this in the Observer today

What is wrong with these people who believe anything but the state might work when it is clear that they cannot?

Richard,

Standing back a moment

I am in a Defined Benefit pension. My pension fund is investing in renewable energy.

It can because what they are interested in is meeting their future liabilities to Pensioners and know what they are committed to paying me. OK not as simple as I make it sound but you get the general idea.

On the other hand if I am in a defined contribution scheme the managers need to know what the value of my pot is at any time I happen to ask, that means that they need to invest in ‘liquid’ investments ie shares and not ‘illiquid’ investments line solar farms, wind turbines etc.

My next question might be to look ‘drill down’ into private pensions, like

What are the administration costs?

What sort of size is the average private pension pot – not very big I suggest

What sort of income might it produce on retirement (in many cases I suggest not much)

I have previously suggested that

1. We need to have another look at what we get from National Insurance, including some ‘insurance based’ benefits, eg Life Insurance and

2. Some sort of ‘top up’ for the current State Pension which I suggest would give many people a much better return than a ‘private’ scheme and in effect require investment in some sort of ‘National Savings’ product which could be for providing ‘Green’ Infrastructure.

This could achieve your objective of providing investment funds at the same time as providing a better deal for future pensioners and cut out The City

Much to muse on

Picking up on the “why doesn’t she want to invest directly in infra”. I don’t know. But let me give you an example of how she could. It’s a good one (well I would say that wouln’t I?).

LINO & Nat Grid are talking about loads more pylons – to carry lots of off-shore wind (mostly). There are some well organised protest groups (some in your neck of the woods Richard) who are less than happy with the prospect of more pylons in Englands green and pleasant land. So far so funky.

Most of the 400kV (& 132kV) pylons that you see marching across the countryside don’t actually carry much current – most of it is concentrated in the skin of the conductor (due to a combo of AC and 400kV – 1st year elec eng stuff). Dynamic line rating and carbon cored conductors and increae carrying capacity by perhaps 50%. Nat Grid part owns a company that produces such conductors.

There is another route: convert the 400kV AC lines to 400kV DC. Then you will increase power carrying capacity by around 8x per circuit (most of the 400kV lines are double circuit lines – 3 phases one side 3 the other). Need AC-DC/DC – AC converter stations @ the super grid subs. Its funny but one of the world’s leading HVDC companies is the old GEC – Stafford & Rugby (prop – GE of USA). HMG could invest directly – & most of the kit would come from the UK.

Will she do it? Maybe I should place a bet @ Ladbrooks – doubtless I would get 20:1 against.

I have a few pages of calcs BTW – the above is not an assertion but an engineering reality.

Oh & Nat Grid thinks new HVDC is cheaper than overland 400kV AC. Thus by extension – converting existing 400kV (& avoiding the need for new lines – is also cheaper).

Wow

Right now I wish my father was around to discuss that with

He designed most of the 400kv lines in the East of England

Fascinating, Mike