HM Revenue & Customs published its new tax gap figures yesterday.

They are nonsense, as they always have been. I have explained why here as part of the Taxing Wealth Report 2024, and I do not propose to repeat the suggestions now. Please follow the link for an explanation.

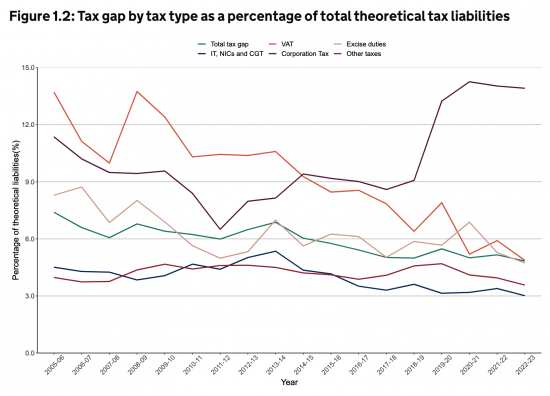

The actual data is summarised by HMRC as follows:

HMRC claim that, in percentage terms, they are doing better than ever.

They are not, I am quite sure.

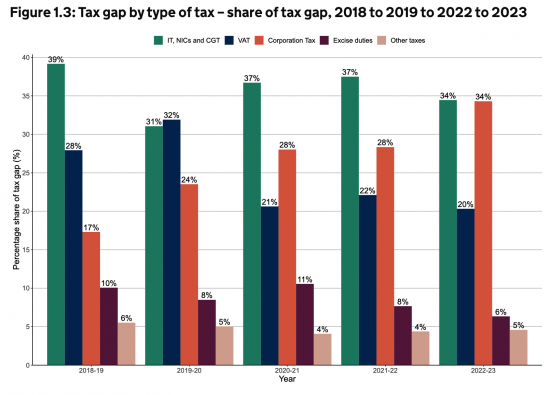

Look at this data:

The corporation tax gap is totally out of control.

But then. also look at this:

Apparently, at the same time as business is not paying its corporation tax liabilities, it is paying a great deal more of the VAT that it owes. That makes no sense at all. Behavioural changes of the sort implied by this data do not happen.

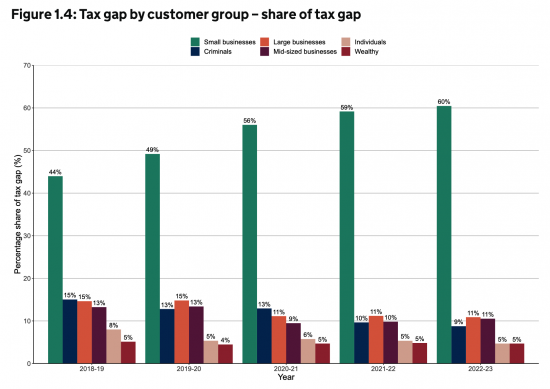

Have a look too at the data on that unpaid corporation tax:

It's all down to small businesses, but apparently, they only do not pay their corporation tax. That cannot be true. If profits are not taxed so are turnover and payroll untaxed, but the tax gap data does not reflect that fact.

This is why the analysis is absurd. It fails to follow through on such issues.

But it's also absurd because tax avoidance is massively understated. For example, all the things that Labour is focussing on as supposed tax avoidance - including non-doms, carried interest and VAT exceptions on private schools are not in the tax gap calculations, although they would be if I had my way, and we also did proper tax spillover analyses. See the Taxing Wealth Report 2024 on that issue, as well.

I spoke to the Guardian about this issue yesterday. They noted these comments by me:

Richard Murphy, a tax expert, said the assessment of tax losses to the exchequer was “seriously underestimated” and that Labour's plans would not improve the situation. He said the amount of tax not being collected could be closer to £100bn.

And I commented on Labour's failure to address the real issues in the tax gap in its election manifesto:

However, Labour's plans target the wealthy, Murphy said, and do nothing to address tax avoidance among small businesses. “The tax abuse scandal is among white-van men,” he said. “But politicians don't want to hear that as white-van man lives in their constituency.”

The last point was based on a comment from a former Labour MP.

So. will Labour beat the tax gap? Not with its existing policies. And not without spending £1 billion to reopen HM Revenue & Customs offices in the community to get closer to the source of the problem, which is something that the LibDems have picked up from the Taxing Wealth Report 2024. If you look in the wrong place, as Labour plans to do, you will never find the tax gap.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Tax avoidance is entirely legal, so why would this be part of the tax gap.

Or is this where you come up with a large number based in the rules being what you’d like them to be rather than what they actually are?

So what you are actually measuring is Richard Murphy’s potential tax gap if the world was an entirely different place and no-one changed their behaviours?

Tax avoidance is not entirely legal. That claim presumes that those undertaking it, with the deliberate intention of subverting the law, which is what defines it, know the law. Time and again it is proven that they do not.

Then let’s turn to the use of tax reliefs. Are you saying it would be inappropriate to reconsider the use of these reliefs, often? Why wouldn’t you want £400+ billion of annual tax spend scrutinised, frequently? Please explain.

Agreed, much of the figure for avoidance is likely under dispute in the courts and will ultimately be payable when the courts rule it is ineffective!

Do you include some tax reliefs (eg isa and Pension)in your calculation of the tax gap?

As a cost of tax reliefs, yes.

In the comparison with what HMRC do, no

There’s a telling point in the summary

The long-term decrease in the percentage tax gap has resulted from the tax gap value in absolute terms (£ billion) growing at a slower rate than theoretical tax liabilities over the time-series.

So HMRC will claim some small wins of course, but the main reason for the supposed success over the long term is the growth in tax due and collected from people who are solvent, honest and alive. Ouch.

🙂