As the FT notes this morning:

The Bank of England's vast sale of government bonds is causing a shortage of cash in corners of the money markets and may need to end, investors have warned.

Over the past two years, the BoE has shrunk its balance sheet from nearly £1tn to about £760bn largely by reducing its holdings of government debt it bought under numerous rounds of quantitative easing stimulus.

As I have noted many times here, quantitative tightening happens to reduce the UK's government-created money supply.

Supposedly, this reduces the rate of inflation. There is not the slightest shred of evidence that this has worked in the UK, where our inflation rate has remained above that of countries and the EU, that have not used the aggressive form of QT that the Bank of England has.

The other reason for QT is to keep interest rates up. By reducing the money supply the aim is to keep up the price of using it. And as the FT notes, this is exactly what has happened.

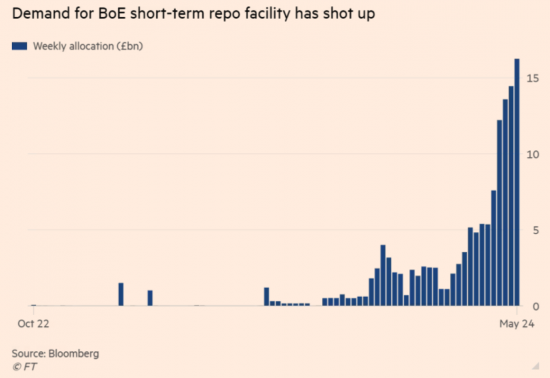

Shortages of liquidity have developed in financial markets as a result of increasing QT over the last year or so, forcing financial institutions to borrow overnight from the Bank of England using the repo (bond-backed) facilities that it offers. The quantity has increased like this:

That indicates a significant growth in the demand for cash to match overnight payment demands by banks and others of late, which can only be because their central bank reserve accounts are being forced too low. The result has been an increase in interest rates:

As I have always suggested, it is clear in that case that the QT programme has always existed as a mechanism for forcing higher interest rates into financial markets and not to reduce the size of the Bank of England balance sheet, which is in itself a matter of total inconsequence, as Japan has proved.

So, what we are really seeing is the Bank of England deliberately increasing stress in financial markets so that the stress on householders via mortgage rates, businesses via loan rates, and renters via increased rental demands continues.

And, as I have always said, all this is for no economic gain, because inflation passes anyway.

So, what is the Bank of England doing? The only explanation is that they are declaring war on the productive economy and households, all to keep rates high for reasons that neither they nor anyone else can explain.

Incompetence on this scale requires the abolition of the Bank of England's independence. But that's not going to happen with Rachel Reeves in charge.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Quite. Not anytime soon.

Rachel Reeves has told us she’s a “social democrat.” Well there’s no “democracy” is there when she lamentably fails to understand how the UK’s monetary system works! After all we make widespread use of money to make things happen in the UK economy especially to ensure well-being of all if we care!

It is an absolute shocker. More so because politicians do not have the appetite or understanding to ask searching questions.

Do you not think it should be the electorate that asks searching questions of the politics?

“what is the Bank of England doing? ……………they are declaring war on the productive economy”

Starmer-Reeves binary system: “we are going to grow the economy”

How, given what the BoE is doing?

What the BoE is doing is reminicent of what Blessing (Bundesbank President & old Nazi) did to Eberhard (German Chancellor & old Nazi) in the 1960s – reduced the amount of money in the economy & caused a recession – Eberhard out. Job done. (Blessing later admitted what he did & why – publicly)

Begs the question: is the BoE setting things up for the binary system to fail?

Surely not.

Preparing for the introduction of CBDCs more likely. We may well at some stage see Reeves solemnly declaring that fiat can’t get us out of the mess the Tories have got us into but that CBDCs can and will. It will then become obvious not only did she used to work for the BoE but she still does. I’ve been suggesting CBDCs could never catch on for general use in the UK as there’s no real efforts being made to maintain the nation’s power supply. Without power, digital currencies (all be they tokens rather than currency) can’t work. Maybe Starmer’s declared intent to create GB Energy isn’t just empty politicking but genuine then.

Eeeek!

What the BoE is doing is surreptitiously cruel. The Governor of BoE is reluctant to lower interest rates, I predict the rates won’t come down by even 1 percent until November 2024. The mortgage and loan payers are being financially crushed to death, what can anyone do? Recession around December 2024 and they’ll have to lower the rates in line with their European counterparts. Mr Ba****, BoE, we can see right through you!! Monstrously cruel.

Leaving to one side the fact that policy rates are too high; leaving to one side that gilt sales (QT) drive up term interest rates (both wrong), I think this is about the BoE failing to understand the willingness (or otherwise) of banks to hold gilts versus reserves. I’m not sure exactly what this means but it does tell us that reserves don’t need to be remunerated in the way they currently are.

Regularly ,Labour spokespersons appear on TV confirming the private sector will fund recovery in the NHS and public services which have been deliberately

put into dire straits by the Tories. What they are asserting has never happened in economic history. The country is almost as clapped out as in 1945. Factories were exhausted. We had lost over a third of our export trade Britain spent more of its national income on war than any other nation. The Labour government produced an economic miracle using public money . In six years they created the welfare state, the NHS which was the envy of the world. The country experienced full employment for the first and only time in our history. Kids from the working class went to university assisted by the government. Young people bought their own homes. I could go on. I am old enough to have experienced the benefits.

At the end of the 1930s there were 13 million unemployed in the USA. The economy was trashed. FDR then engineered the New Deal. He spent huge amounts of public money , the economy began to recover. Then the USA entered the War. Public money spent on the war machine saw the USA become a super power . The industrial /military complex is still in operation. Public investment again. In the last 40 years China has become another super power using public investment to prime the pumps. The Labour leaders must be totally economically illiterate if they expect private money to get the UK out of the disastrous situation it is in. I saw Richard’s video on YouTube this morning asking why Labour is lying about the lack of funding. Its not possible for me to grasp the reason for these untruths. Its baffling.