I made a suggestion in a video yesterday that it is now essential to the restoration of balance within the UK economy that the accumulating pile of savings that the last decade has created should be directed towards social and productive purpose when that is not the case at present.

To give some illustration, wealth has increased dramatically over the past decade. As indication, maybe £70 billion a year goes into ISAs, and more than £100 billion a year into pensions. The tax subsidy to achieve these contributions costs almost £60 billion a year. In itself that is a cause for asking why a social dimension is not required with regard to these savings, but there is another aspect to this.

Savings have not just gone up because of the sums saved. The extraordinary increases in wealth cannot have happened for this reason alone. Instead, they have also happened because of the deficits that the government has run over the last decade.

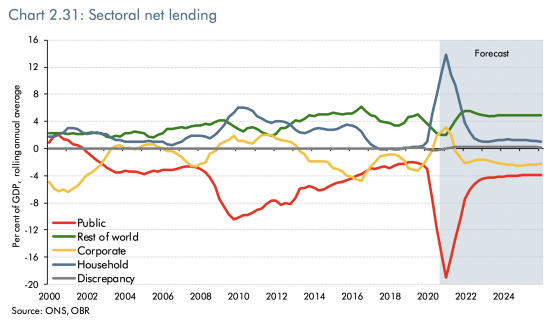

Those deficits have been necessary and appropriate. Indeed, they may well have been too small. But they had an inevitable consequence. When the government runs a deficit someone else has to run a surplus. That's a fact dictated by double-entry accounting. The sectoral balances show this. This is the latest UK version, from the Office for Budget Responsibility:

As deficits go up so too do savings. And so, the stock of savings in the UK has grown.

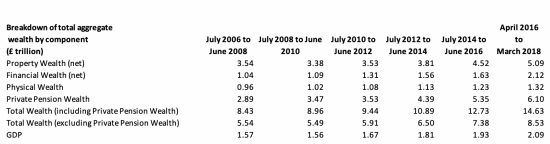

This has had an exponential consequence. Since almost all this saving has gone into land, housing or shares, all of which are kept in deliberately short supply by markets keen to maximise profit, the prices of those assets have risen, considerably. The result has been an even greater increase in wealth than there has been in savings. This is data from the ONS from last April when I last looked at the data on this in detail:

I am sure that not much has changed since then in terms of the trend.

But there is a problem here. QE, rightly or wrongly, has been in use for a decade now. And what QE does, quite deliberately, is to force money out of safe bonds and into speculative investment, so pushing up the price of both with the intended aim of reducing effective interest rates. It does then, effectively, inject hot money to fuel speculative activity into the economy.

There are massive consequences of this. One is the resulting enormous increase in financial wealth, and so an increase in inequality.

Another has been an increase in the return to speculation that has discouraged any form of real investment, at cost to real production and jobs within the economy.

The third is a complete disconnect between financial markets and real investment return.

And fourth there is always a risk that the financial markets might crash, simply making overall economic well being worse, and not better.

And fifth, whilst all this is going on, many quite reasonably resent it and become alienated from society and politics which they correctly see as offering them very little of real consequence, whilst the returns to a few rise exponentially. This is a recipe for the social breakdowns that we are now witnessing politically.

My remedy is to address the disconnect between savings and investment in society. My logic is as follows.

First, there is a massive investment shortfall in society if we are to meet current needs for new infrastructure as well as creating the transition to sustainability that we require.

Second, we need this investment to deliver the recovery that is now required post-Covid.

Third, the subsidy that the state gives to the already wealthy by providing them with incentives to save must be applied for social gain. It's hard to imagine a counter-argument.

Fourth, inequality must be tackled. Even the IMF and OECD now say so.

Fifth, we must seek to avoid a financial crash which continuing QE of the type now used might promote.

Sixth, further QE of that type plus any increase in tax or borrowing must be avoided, as all work against achievement of the above objectives.

Seventh, so too does simple money injection work against that objective since it too increases the sectoral imbalances and does therefore increase savings, whether that is the intention or not, meaning that modern monetary theory has not got all the answers on this.

Which means we have to do something more radical, which is to now reconnect savings, and those that we subsidise through the tax system in particular, and the real economy by encouraging the rather novel (as it turns out) idea that savings might be used as capital to fund the investment that we need for the benefit of all in society.

Doing this is easy. As I have noted, the relationship between tax reliefs and savings in the UK is very marked. Something like 80% of all private wealth is saved in tax incentivised assets, whether that be pension funds, ISAs, other tax driven schemes, and housing, which is massively tax subsidised by being free of capital gains tax.

So, ISAs must only be allowed in future if the ISA funds are invested in bonds that in turn fund activities that can be shown, without doubt, to produce new jobs that support the required transformation of the UK.

I also suggest that 25% of all new (not existing) pension contributions should be required to be invested in the same way.

Together these two measures could result in maybe £100 billion a year of capital being available for investment in the UK, which is more than enough to fund the Green New Deal (which the Climate Change Committee thinks might cost £60 billion a year) and ample other social investment as well, whilst freeing government revenue budgets to address other vital issues, like health, care, education and justice issues.

How could this be done? I suggest that hypothecated bonds be issued. These could be regional (big enough to be effective, but small enough to be local e.g. East Anglia or South Wales) or they could be activity focussed e.g. health, housing, the Green New Deal, and so on. There is no reason not to do both, and mix the benefits.

The bonds would be invested fir the use for which they were subscribed. But the investment projects and their amounts would be set by government. So investment limits may have to be set, and government should also make good shortfalls: this should not be a rationing mechanism.

As important, the interest rate should be the same for all funds, and be both attractive in the market (above average, towards top end for the periods offered, and locking up funds for a period would be part of the deal) and guaranteed by the government. It could also be tax free, as ISAs are.

Redemption should always be possible. Normal circulation should cover this issue. If not QE could, but that would be Green QE in this case, because the funds would then be linked to a specific purpose and not be randomly allocated within markets.

Long term capital redemption would be funded by renting assets created to the government. If funds were made available to the private sector (and they might be, via a National Investment Bank, acting like a venture capital fund) they would obviously be expected to pay a return.

And the interest would be covered by government. Suppose the rate might be 1%. On £100 billion that's a £1 billion annual cost. Let's not over-sweat the cost in that case. Putting a cap on balances that might be held in these accounts (less than £500,000 I would suggest, and maybe more like £100,000) would make sure that not to much of this is captured by the already wealthy.

So why do this? Because it solves the problems I note, which are real, politically, socially and economically.

And why do this, rather than do existing bonds as I have been asked? Simply because these existing bonds might be economically ‘efficient' but they create the social, political and economic consequences I note. Efficiency is a very long way from being the criteria for success in the political economy that I care about.

So will they work? In terms of attracting funds I have not a shadow of a doubt. I think people would be queueing to get them.

In terms then of freeing the government to fund other activities, I again have not a doubt.

In terms or promoting an awareness of the relationship between savings and investment, that will depend on the marketing and reporting. It will be vital that people think there is a relationship between their savings and outcomes. Good reporting will then be vital.

And in terms of additional funding for investment? I am sure that will happen.

Whilst tax reliefs will be better spent.

And two other things will be achieved. Savers are older. Those who will get work from this will mainly be younger. This activity could promote inter-generational solidarity in that case, which is now vital.

In the process it could also underpin what I call the real pension contract (explained here) which requires inter-generational transfers of income and wealth.

We will also get a Green New Deal, better housing, schools, hospitals, transport and other infrastructure. And by freeing government budgets for alternative use other than funding investment we will end up with better services too.

We could even have full employment. And for those who worry about such things, balanced budgets follow on from full employment.

Now, what is not to like?

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

I have no doubt of the good intentions of hypothecation. I may have missed its successes, but I can think of many examples of its abuse (e.g., car tax). I would wish to see the framework for the audit of the hypothecated savings, but forgive me if I will be sceptical; after all, this is Britain.

We have a wretched track record of regulation or audit in Britain; the skilful capacity to divert hypothecated taxes into an opaque soup, behind a veil of obscurity and without acknowledgement has become routine. Britain also has an appalling record in regulation: whole Government Departments eg., ‘Agriculture and Fisheries’, ‘Financial Services Authority’, remember them? They just disappear after their hapless failure to regulate is revealed. I sometimes think regulation in Britian is calculatedly designed to fail.

The ideas for hypothecation are not hard, the structure of regulation is the difficult part, but rarely receives any attention.

Noted

John W – I’m not sure that the hypothecation of bonds creates the sames issues as hypothecation of taxes. It is not a good idea to hypothecate taxes, firstly for the good reason that they don’t fund public spending in the first place and second because if they did fund public spending it would not be a good idea to allow people to choose what they want to pay for and what they refuse to pay for. Hypothecation of savings – as this is what hypothecation of bonds is –

is OK because it gives people choices about how to use their savings. Taxes belong to the government, savings belong to citizens – that’s the difference.

In terms of regulation, the key issue is accountability and transparency in the activities of the National Investment Bank or other similar institution so citizens can see that their savings have been used for the purposes for which they were lent. Other similar banks could be a Land Bank, an Agricultural Bank, an Energy Bank, an Infrastructure Bank – the NIB could be a more general public bank supporting business more generally.

I am opposed to the hypothecation of taxes

But bonds are not compulsory: they are voluntary subscriptions for capital and so utterly different

And I am saying there would be subscription limits and also government guarantees that desirable schemes would go ahead – so this is not really anything like tax hypothecation at all

“In terms of regulation, the key issue is accountability and transparency in the activities of the National Investment Bank or other similar institution so citizens can see that their savings have been used for the purposes for which they were lent. ”

Well, I was easily disposed of; but I don’t think so. Yes, I agree it is not exactly like hypothecated taxes. My point however, I believe still stands. I was perfectly aware of your point, but rejected it – because it is just too easy to offer that solution. Your quotation above, I think rather makes the point; “accountability and transparency”.

Well, of course; but we have been here before. What makes you think that if Governments can avoid accountability and transparency into the use of hypothecated taxes so easily, a bank (a bank, please note) will provide a better account of them, or a regulator will not simply follow standard British procedure: become the creature of the institution it is supposed to be regulating? This outcome is demonstrably true, from real experience; time after time. Accountability and transparency did not work well in the years up to the 2007-8 Crash. The Financial Services Authority is no more; but too late.

There are two reasons that ‘Safe Assets’ are currently so scarce throughout the world; the first is a function of problems in the global economy, see Caballero et al, ‘The Safe Assets Shortage Conundrum’ (2017). The second, I believe is a public loss of confidence in anything outside the money and near-money securities of stable currency issuers, in their own currency – a loss of confidence that has happened, with good reason.

If the proposed green bonds here are going to attract wide support (not just risk takers), it will require a scale and effectiveness in the optics of transparency and accountability that I have never seen. I fear we at best will create yet another ‘too big to fail opportunity’ created by yet another, predictable failed regulator. It is for those who propose this (I do not challenge the desire) to demonstrate that this will work. That is a great deal harder to prove that it seems.

John

I note what you say

But if I g9ve up on believing better is possible I have nothing left

So I don’t

And that’s why I suggest accountancy and transparency are possible

Richard

Richard,

I accept your answer, but while I think your background in accountancy makes your analysis particularly relevant, even hopeful; I wanted to underscore the nature of the problem. It is not the green bond alone that needs careful preparation (that can be done), but the nature of the regulatory framework, and how it is going to be ensured that the system holds up to pressure. That is the critical issue, and there is no template.

We go round this self-defeating circle endlessly in Britain with regulatory failure of vital, major institutions; the same pronouncements, the same assumptions, the same hubris, the same failure, the same abject weakness, the same inability to stand against conventional complacency, the same blindness; in retrospect, after the wringing of hands, the shock and outrage, it quickly turns to ‘its nobody’s fault’, move on, we have whitewashed the mess away, nothing to see here. Nobody learns anything, nobody remembers anything, nobody changes the substance, nobody changes the system, and nobody cares. Until we start the same old cycle again (because it works so well for smooth, ‘nothing to see here’ government), with the same protestations that it is going to be different this time. Util it isn’t; again….

John

I know all that

So we have to create new models

I might be naive. But I can hope

Richard

I agree with every step here. Well thought out.

I had thought Rishi Sunak had committed to green gilts as recently announced.

https://www.dailymail.co.uk/news/article-8931977/Rishi-Sunaks-bond-raise-green-cash-Investors-able-raise-money-eco-projects.html

But on reading the Govts Green Finance Strategy , I see that is not in fact the case. Surely a case for some clear blue sky between Labour and Tory?

https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/820284/190716_BEIS_Green_Finance_Strategy_Accessible_Final.pdf

“At present the Government does

not plan to issue a sovereign green bond, given

the absence of significant barriers to market

for corporate issuances in the UK. In addition,

the Government does not consider a sovereign

green bond to be value for money compared to

the core gilt programme, which remains the most

stable and cost-effective way of raising finance to

fund day-to-day government activities (including

existing and new green expenditure). This owes to

the strength of investor demand for gilts, the well established nature and size of the market, as well

as the fact that gilts can be built up to benchmark

sizes across a range of maturities, resulting in a

highly liquid market and diverse investor base. “

Edit,

Was on page 63 if you wish to check.

@ John

What you argue is an important point. I’m close to issuing my explanation of the relevance of Christine Desan’s work to MMT including discussion of the 1672 Stop of The Exchequer. This will explain that during Charles II’s reign government was split between him and Parliament. This led to a lack of responsibility in funding the collective problems England had to face. Charles ended up desperately trying all kinds of ways of finding funding particularly borrowing but this led to the ludicrous situation of all of a year’s revenue needing to be used to be spent on the repaying of the interest on his borrowing, hence the desperate resort to the Exchequer Stop.

Clearly over the ensuing centuries Parliament has come to resolve the issue of split power to a large extent but issues remain of “rationally” balancing public and private interest in regard to funding matters of collective interest and the accountability that must run alongside that. I cannot see that the UK’s First Past The Post electoral system is the best way of doing this since it’s ended up with the alternation of two parties in office who believe, or profess to believe, the government operates on a credit card. An alternative electoral system must surely be better to allow challenges to the conventional wisdom on government funding as well the state of accountability on any hypothecated methods being used ???

Mz Schofield,

I look forward to reading it. I suspect that Charles II’s resort to ‘Stop the Exchequer’, as well as his sometimes casual approach to sovereign obligations (save in duress), which should at least have mirrored his over-awareness of his sovereign prerogatives but to which he seemed to have a blind-spot (perhaps a remnant of the reliance of the later Stuart’s on the absolutist political philosophy of Jean Bodin), perhaps led in part, or additionally, finally to the exasperated resignation not just of Whigs, but even of Tories; to abandon the Stuarts, in the forlorn personage of James VII and II in 1688-1689.

A lot of what you say here doesn’t make any sense.

The purpose of ISAs and pensions is to save for retirement, and reduce the burned on government in paying for retirees.

Remove the tax breaks for doing so and those savings become less viable. More so when you consider that drawings from pensions are taxable.

Force people into specified low yielding investments such as bonds would also simply men a lot of people wouldn’t bother to invest. If there is no tax advantage, and your return is going to be very low, and potentially negative given inflation, why would any sane individual do it.

That isn’t the main thing I wanted to ask you about though, as per my comment on the other thread.

You just state that these bonds should exist with a given interest rate. But bond markets don’t work like that.

Firstly, a bond needs some revenue stream underlying it for repayment. Many of the localities or things like the NHS would not have a significant income stream to service this debt, so a bond issued by them would be of a low credit rating and have a very high yield. Muni bonds often have the highest default risk and lowest restoration values, with correspondingly high interest rates.

To get around this problem, you say government should guarantee them. At which point, they are just government debt, and would trade at the same yields as other Gilts.

You can’t set the interest rate at some particular level. The market decides his simply through the action of what price (and therefore yield) people are willing to pay for a bond. You can set the coupon, but as everyone should know, this is immaterial to the interest rate on the debt.

Which leaves us back at square one really. Green and Muni bonds already exist. The former are exactly the same as other government bonds, and trade exactly in line.

The latter, when not guaranteed would trade at a variety of different spreads – but always higher than government bonds. If the US is anything to go by, anywhere between 1% and 5% higher for investment grade (AAA-A) rated bonds, and much higher for junk. To make them investable, most muni bonds in the US are tax free. If you did put a government guarantee behind them, then they would trade in line with Gilts. So why issue them?

At the end of the day, what you are really saying is that the government should simply spend more and issue more debt. Which has it’s own issues. Just look at US Treasury yields, inflation and breakevens at the moment. You are trying to put a spin on it, by saying it should be for social purpose – but that doesn’t exclude regualr government debt being for social purpose as well.

You are also trying to say that people should be forced into buying more government debt should they decide to save or invest, and that such saving should be taxed more highly or lose tax breaks. Which would have the opposite effect if you are trying to encourage investment in government bonds.

Your thinking doesn’t seem very joined up. What you are trying to put forward wouldn’t work in the real world in the way you say it would.

Michael

I will assume you are in financial services

I think you somewhat misunderstand the purpose of ISAs which were never meant to be a pension product

Actually, I think you also misunderstand pensions which after Osborne are only savings products

I happen to think you have also got risk wrong, and have many issues on bond pricing that you also have wrong – where very clearly markets do not price bonds, even if you wish to think that they do

But most of all, I am not suggesting people but existing bonds. These would be retail products. I will ex0plian how in another blog, tomorrow

In the meantime:

a) You still really do not get the social issues – and if you do not then you will never get this

b) We do need substantially more government spending in the long term – I suggest you deal with it

c) I am not suggesting anyt9one lose tax breaks – I am just changing them

d) I am not suggesting any9nbe be forced to buy anything – I am just saying tax breaks come at a price.

Do you really think the opposite of (d)? Why? What’s the reason for your desired free ride?

Richard

Richard,

I am in financial services.

I never said ISAs were a pension product. They are a long term savings product.

Markets clearly do price bonds. You can only sell a bond at a yield someone is willing to buy it at. The issuer doesn’t determine the yield of the bond, and thus the interest rate they pay over the life. This is basic bond maths.

Retail products are highly illiquid, and would not be suitable for pension fund investments, notably because they are not listed instruments. Retail bonds also wouldn’t be sold in anywhere near the sizes you are talking about, if the current retail bond market is anything to go by.

In the meantime:

a) This is totally off topic, so doesn’t really warrant an answer.

b) This seems to be your answer for everything. You don’t seem to care about the risks of his ever increasing spending though. Or have bothered to look at value for money, demand or requirement. You;ve just picked large numbers out of the air.

As I said, just look at US treasury yields and inflation at the moment.

c) You literally suggested that people be forced to invest a certain percentage of their pensions in these bonds. Forced.

“I also suggest that 25% of all new (not existing) pension contributions should be required to be invested in the same way”

Unless required means something else now.

d) See above. If you force somebody to buy something which provides no return or lose the tax breaks, you will simply have people find other ways to invest, or not invest at all.

Investing in long term bonds at negative real yields and extremely low nominal yields is a sure fire way to generate a loss. Guaranteed, by definition. So why would people buy them? The only buyer of Gilts at the moment at current yields is the bank of England, so why would more bonds at equally low rates suddenly change this? People aren’t stupid.

Losing the tax efficiency of saving will also make people save less. I hope you can at least agree with this.

So people simply won’t do it, and will spend the money on other things instead, perhaps on other inflation proof investments. Housing maybe.

Your language is not very helpful

You know no one is forced to have pension?

And all you can offer is deeply dogmatic standard right wing neoclassical arguments that reveal a decidedly naive view of the role of the state that you obviously think is a provider of largesse for a few but without responsibility to many.

I am nit sure that provides any useful basis for discussion.

“Your language is not very helpful”

I read this as, not helpful because I don’t agree with you.

“You know no one is forced to have pension?”

You what? Auto-enrollment has been around since 2012. It is very rare tht anyone opts out and stops all pension payments, and difficult to boot.

Though if you forced every saver to save in assets which are guaranteed to lose them money, I guess the opt outs will increase.

“And all you can offer is deeply dogmatic standard right wing neoclassical arguments that reveal a decidedly naive view of the role of the state”

Nothing right wing or dogmatic about what I have said. Just realistic.

You haven’t done your homework on these bonds. They will either trade at much higher yields, or will be government bonds. Nobody is buying government bonds at these yields. Except the Bank of England. You haven’t done any analysis on what extra spending is needed, how cost effective it would be and any benefit analysis. You’ve just picked a wish list of projects and made up some suitably large numbers. Then want to force people to pay for it by higher taxes or proscribed investments.

You do understand that the government serves the people of the UK, not the other way around, don’t you?

“that you obviously think is a provider of largesse for a few but without responsibility to many.”

Are you jsut trying to insult me? Or play some sort of moral one-upmanship? Pensioners are a very large percentage of the population, and all of us will be at some point. Enabling comfortable retirements for people to enjoy, especially if it based on the money they earned over their working lives, taking responsibility for themselves, is a good thing. Your suggestion would force people into much poorer retirements, or the government to pick up the bill.

How is that fair or responsible? Or is it that your pension looks a little bare and this is all born of jealousy?

“I am nit sure that provides any useful basis for discussion.”

No. I’m starting to think it isn’t. When someone starts talking about bond issuance but doesn’t have even a basic understanding of bond pricing, you are probably on to a loser. Or talking with one, let’s be honest here.

When I see someone resorting to claims of jealousy I know that finance professional or not I am dealing with what feels like a troll.

And the rest is just groundless – including despite your very obvious lack of awareness of the hopelessness of private pension provision for most people when the costs of your industry destroy any hope of real returns. I would suggest my plan massively more sensible fit most of the small pots involved

I read profound privilege without a clue about the world to come – or anything about what government is all about. It is not about shovelling wealth upwards. That may come as a surprise to you.

Nor have you bothered to note the type of bond I am describing – a retail bond for most people

I fell sorry for your customers but I suspect most are as out of touch as you are

“When I see someone resorting to claims of jealousy”

I can’t think of any other reason you want to tax people’s pensions more or force them into investing into assets with negative real yields.

“including despite your very obvious lack of awareness of the hopelessness of private pension provision for most people when the costs of your industry destroy any hope of real returns.”

Across the pension funds we manage, which are mostly DB, we are seeing real returns of about 2.5% p.a. after fees. Higher actually in the last 12 months, despite Covid. The portfolios are held in a diversified range of assets, hedged against interest rate moves. Most have a significant ESG tilt. Almost all the schemes are now fully funded, and the rest should achieve that in the next few years – which after Gordon Brown’s last tax raid on pensions wasn’t always the case.

You are suggesting people should lock their savings into long dated illiquid bonds yielding 1% nominal, which is going to end up as negative real returns if inflation moves even a tiny bit higher. That is before you you factor in the losses people will suffer if bond yields move higher.

“Nor have you bothered to note the type of bond I am describing — a retail bond for most people”

I noted it several times. They are not suitable pension fund investments because they are not liquid and not listed. Which means the volumes that will be bought are going to be relatively small, and nowhere near the amounts you are talking about. Though I think more than anything you are backpedaling because the idea of hypothecated bonds doesn’t work, so now you need another way of maintaining your limited credibility.

After all, I’ve already pointed out that hypothecated bonds would either be a lot more expensive (higher yields) or be identical to other government bonds. Which nobody is buying because of the negative real yields and massive inflation breakevens. At which point…what’s the point.

“fell sorry for your customers but I suspect most are as out of touch as you are”

Over 100k customers seem pretty happy with us. We’ve improved the outlook and security for their retirements. But you, self-righteous much? Your first instinct was to remove tax breaks or force them into investing in assets which are guaranteed to lose them money. Because in your mind they are all “rich”. You have no idea who these people are or what they do. But are more than happy to lay claim to a portion of their retirement funds. Tells me all I need to know.

But hey. If you are affiliated with a university, you are probably in the USS scheme (which we don’t have involvement with). They have a massive £18bn deficit and liabilities increasing at RPI+. Why don’t you go and tell them they should invest everything in Gilts or other bonds with negative real yields and effectively zero nominal yields, and see how they react? I mean, I’m sure everyone would be fine if they were told the scheme could provide less that 80% of what was promised, because someone without any financial industry experience told them that buying lots of bonds was the way to go.

You really do not cover yourself with glory with those comments

I hear self-satisfied financier happy to live off state subsidy funding excessive fees generated from recommending hollowed out investments that have no chance of making it to the long term

Read what I have to say today

Read this https://www.sheffield.ac.uk/news/polopoly_fs/1.892482!/file/Against-Hollow-Firms.pdf

Read what I will say about Astaa Zeneca, maybe tomorrow

And you keep ignoring the afterthought in today’s blog

Actually Micheal’s comments here serve one purpose, we can see the crazy world we now have to live in to survive in old age. The thought that this is not the only alternative seems to pass most of us by, especially those in the industry who make nice salaries and bonuses from that very process.

No one should make a profit from my fear of destitution. Least of all, a financial sector that has proven to be not fit for use on a grand scale.

It is time we had a major rethink about what money is and how we better use it, we have not used it so well for the last 400 years to be frank. Michael and his ilk just see money and interest and have no concept of how that money appeared nor the democratic rights we should have to have some say on that process. We should never accept the current money creation system, it is an abomination.

Whether we actually have Green bonds or not, how we create and use money remains THE big issue. Personally I like the idea of Green Bonds, we tend to have a lack of transparency regarding most of our pension investments, or even bank account investments. but we would still need a democratically elected govt to impose it.

“I hear self-satisfied financier happy to live off state subsidy funding excessive fees generated from recommending hollowed out investments that have no chance of making it to the long term”

I guess you hear what you want to hear then. But what you say is utter garbage.

Not taxing something is not a subsidy.

You clearly have no idea what fees the fund management industry charges. 1% p.a. would be considered very high in most cases. I believe the average is down to about 0.35% to the end user.

Our investments change all the time, but our long term returns are pretty good and stable, for an extended period of time. Having a diversified investment process across a large range of available assets means we can minimize risk whilst maximizing return, and the risk of total or catastrophic loss is negligible.

Your plan is to force people to invest in an overpriced, potentially risky asset which has negative real yields and is exposed to potentially large capital losses if interest rates or inflation rise. Sounds like a much better plan.

“Read what I have to say today”

A report which clearly you had very little input into. Which frankly doesn’t say a great deal either. To anyone with any knowledge of financial markets, it is obvious why the thing laid out in report are happening. What the report doesn’t do is mention the elephant in the room – which is financial repression by governments/central banks printing too much money via QE, suppressing interest rates to extreme levels and in the process totally distorting the risk/rewards at both a corporate and investor level. I mean, it’s hardly a surprise corporates are going to issue debt when it is incredibly cheap for them to do so, to repurchase equity which is a far more expensive funding mechanism.

It’s almost like the people who wrote the report have only looked at financial markets for the first time. This is graduate trainee level stuff.

“Read what I will say about Astaa Zeneca, maybe tomorrow”

Let me guess. It will go something like evil AZ, good EU?

“And you keep ignoring the afterthought in today’s blog”

You keep avoiding any of the points I make and come back instead with ad hom attacks on me and the financial industry. Your idea is flawed on several levels and would actually be detrimental to both investors and government as people would be less likely to invest, not more.

I think it’s time you went elsewhere Michale

I have been very patient in explaining my ideas for your benefit, but you give all the impression of being unable to comprehend logic that many on this site find quite comprehensible, whilst also dishing out abuse, e,.gl. on my work with Adam Leaver et al about which you can have no knowledge, whereas I have fully informed myself of the facts surrounding pensions and the economic issues to which I refer.

No wonder pensions fail to deliver so badly, and people like you continue to funnel money not hollowed out entities, as I have evidenced in case you call that abuse.

I would not bother to reply unless you begin to engage with reality.

there are a couple of separate themes here.

On tax advantages I think it is entirely reasonable to put conditions on any tax-advantaged savings…. exactly what conditions are up for discussion. Personally, I would put a tight cap on the amount that can be held tax free. I am happy to encourage “ordinary” folk to save for their old age but the truth is that rich people will save for old age whatever the tax situation so we should focus the tax advantage lower down the income spectrum. It might make sense to put an “unrestricted cap” at a low-ish level as youngsters starting out saving for a pension should probably be in equities. Once you hit a certain level the tax advantage could then only apply to Green Gilts.

On your point “what’s new” in some senses you are right, the government could just issue more gilts to fund whatever projects they like (I don’t think Richard is looking for a Muni market or asset-backed market in the UK). If they did that I would be happy but the reality is that politics does not permit it. We face several challenges (1) huge investment is needed in many areas and some – particularly surrounding climate change – can not be done by the private sector. Flood defences might be a classic example here. (2) QE, which was designed to push rates lower and promote investment is not working – it is merely driving up the price of existing assets. (3) Old folk like me have nowhere to stash their wealth that might get close to matching inflation as they approach old age.

Green Gilts solves (to some considerable degree) all three of these issues.

With regards to yields, then they would rise – that is the idea. Higher rates would discourage a lot of speculative activity in property and equities. Rates would be set by the market…. with the clear understanding that government is an active player in the market choosing whether to issue and at what rate or, indeed, to buy back (QE). I would expect something like 2% for long dated Gilts (Green or otherwise)

All noted and appreciated Clive

I will elaborate more in the morning – but a great deal of this is along my lines of thinking

I read this in today’s Independent Richard

‘UK could become a ‘failed state’ without reform, Gordon Brown warns’

Britain risks becoming a “failed state” without serious reform to its governance structures, Gordon Brown has warned.

Writing in the Daily Telegraph newspaper Mr Brown said “the choice is now between a reformed state and a failed state dissatisfaction is so deep that it threatens the end of the United Kingdom.

Brown warns ‘rebellion across country’ without anti-poverty measures

“For the first time, a majority of Scots now feel, according to recent polls, that Scotland and the rest of the UK are moving inexorably in opposite directions and nearly half of all Scots who have a view believe – AGAINST ALL THE EVIDENCE – that Scotland would be better off economically independent, and they feel that the Union undermines Scotland’s distinctive identity.

May I suggest this needs an evidence based rebuttal from your good self..

No time right now, I am afraid

“Now, what is not to like?”

Nothing!

What I really like about it is that it is a truly practical policy. It takes the the financial infrastructure and political/social landscape “as it is” rather than “as we wish it were” which means that, with political will, this could be up and running quickly. It is also a narrative that will chime with the public.

As a “bond anorak” I offer some thoughts……

The Municipal Bond Market in the US (“munis”) offers lessons about how this could work…. and also what to avoid!

It offers tax advantaged bonds to State residents for certain purposes backed by certain revenue streams. It is a massive market which demonstrates clearly that there is demand from individuals to buy bonds.

[It also illustrates some pitfalls; first, because they are not credit risk free (ie not federal government) you find that bondholders demand that interest and principal cash flows are backed by certain assets it produces a whole host of issues that tie the hands of States, second, they can be fiendishly complicated].

It is clear to me that all Government Green Bonds, for whatever purpose, should rank equally with gilts (creditwise) and repayment should NOT depend on the success or otherwise of the project they finance.

I also think that the tax advantage should be with the holding vehicle (ie. ISA or Pension) not the instrument (like US Munis).

What would a Green Gilt look like? The potential problem is that the Government and wholesale market wants long dated, fixed rate bonds and individual savers might not like that product.

Currently, very few savers buy long dated gilts – they prefer shorter products offered by banks and building societies (at present, generally, fixed rate bonds sold to retail savers are not true bonds; savers can redeem early with some penalty (usually 90 days interest) and there is no secondary market to sell bonds (although NS&I no longer allow early redemption on recently issued fixed term bonds).

Should we (or could we) encourage retail savers into long dated fixed rate bonds?… or should we construct “retail friendly” products more along the lines currently offered? I suspect that the key element is the one you identify “save to build a hospital” WILL get savers excited rather than “buy gilts to fund the deficit”.

So, on balance (and there are arguments both ways) I think the Green bonds that individuals buy in their ISAs should be the same instruments that trade in the wholesale bond market. There will be some education needed to get savers to understand that “the price of your bond can go down as well as up” but these are not insurmountable. The DMO can then issue bonds in the different categories (NHS, flood defence etc.) and maturities in line with investor demand (both retail and institutional). How would savers deal in the market? My preference would be for the BoE to quote dealing prices each day where retail investors can buy and sell as they wish (along the lines of the Bundesbank used to do in Germany “back in the day”). Savers could then hold these bonds in NS&I accounts.

Again, all this is fairly trivial detail but does demonstrates that the infrastructure is already there to deliver the policy..

Interesting, because I saw these as retail bonds.

Let me do blog on that for tomorrow….. not time now and it’s worth addressing how I see risk man agement working in this scenario

They could be…. it is not clear which is best. My background might make me “one-eyed”…. I think everyone should trade and invest in bonds!

I have been labouring under the misapprehension (?) that the Green Bonds were not Government issue. Of course, if it is a bank or banks (or other private institution) that issues them, then my concerns would also be assuaged if the government was going to guarantee the public up to, say £85,000 (cf. personal banking) of their investment in the bond. I offer that example because I see no reason to re-invent the wheel, when the wheel clearly worked.

They would be government issue

More tomorrow

Actually, in the case of a ‘private sector’ Green Bond, a Government guarantee to a limit (say, £85,000) has the double benefit of providing the public with the reminder that beyond the guarantee this is a risk investment, not a true ‘safe asset’. It also reinforces public understanding of who actually provides genuine ‘safe assets’.

As I will be discussing tomorrow

It’s high time we took a good hard look at the word “hypothecate” which comes from the Greek “to be given as a pledge.” It strikes me that we can consider it as a mechanism in which government pledges to create money to support a specific purpose “or” it pledges to support a specific purpose by providing a tax break. Indeed there’s no reason why it, the government, shouldn’t combine the two approaches for the specific purpose. In other words it uses its powers to inject and retroject, to advance and retire currency. Taking an eagle eye’s view what is government achieving by engaging in “dual-hypothecation”? I would argue that it’s making the value of the money held (for example in a bond since this is the topic of discussion) appear to be lasting as long as possible, making it “safer”. Are there further examples for this argument? Well yes look at the contractural deal that enabled the Bank of England to be set up in 1694, look at the latest thinking on what constitutes a safe-asset, see page 8 on the following Christine Desan paper including note 33:-

“The Monetary Structure of Economic Activity”

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3557233

I like that

Richard,

A few comments

If we are looking at pensions, why not

1. A better basic state pension, and

2. Rather like an AVC, a facility to buy extra state pension – at the moment I can increase the value of my State Pension by deferring when I take it but I cant buy more before I retire.

Secondly as you have raised the issue of shares, should we be looking at moving away from Ordinary shares back to preferred stock, ideally with a redemption date as a way of funding publicly quoted companies, ideally with them using this instead of banks for funding?

Both worth considering

Thanks

[…] wrote yesterday about my idea for issuing bonds to fund the new investment that will be required in the UK…. My suggestion was that these bonds should be hypothecated in the sense that the proceeds of any […]

[…] Translated, that means QE is going to continue, but the IMF is well aware that there are very real risks in markets. This is, of course, precisely my motivation in discussing alternative bond investment structures this week. […]