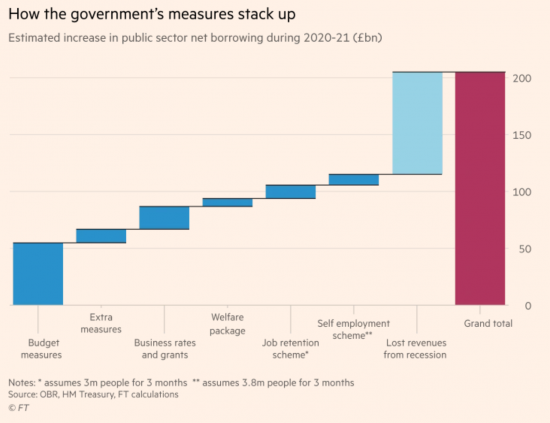

The FT has this estimate of the scale of the UK government budget deficit in 2020/21 in the paper today:

I think this is a serious underestimate.

How only 12% or so of UK government revenue is going to be lost when the economy is going to be closed for at least three months, and probably a great deal longer, and the recovery is going to be very slow indeed is hard to imagine.

Add in the potential for substantial post-lockdown unemployment as hundreds of thousands of businesses will fail either during the lockdown or when they try to restart due to then having insufficient working capital, coupled with the need for significant increases in public spending on the NHS and much else and the deficit is going to skyrocket.

Once the necessary support measures to start the economy going again, when that happens, are also added in I think it's quite possible to imagine this estimate at least doubling.

It took more than a decade for UK notional national debt (without QE being taken into account) to increase by £1 trillion after 2008. It will take much less time to repeat that on this occasion. However, after QE (which cancels the debt that deficits notionally create because the government buys its own debt back when it does QE, and it cannot owe itself money) the increase in real debt may be quite modest in my prediction. QE funding, or variations on it, will run almost in parallel with the deficit in my expectation, as it did for much of the period from 2009 to 2014. As a result the supposed 'cost' to taxpayers will be minimal.

We need to get our heads around all this, and soon.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Hi Richard,

I’m reading things like this article – To help fight Covid-19 the Bank of England must commit to direct monetary financing

https://positivemoney.org/2020/03/to-help-fight-covid-19-the-bank-of-england-must-commit-to-direct-monetary-financing/

And I Sky had an interview with Lord Myners on the topic

https://www.youtube.com/watch?v=rcLL3G_G-b0

Is this the same thing you’re talking about here? I’m a little confused by it all.

I appreciate it’s a massive subject, but if you could try to put some clarity on it for me, or maybe point me in the direction of some sources it would be great.

Best Wishes

Tom

Direct money financing cuts the banks and other institutions out of the QE process

The bonds are never sold to the market for the Bank of England to rebuy them: it simply buys them direct from the government

It really is about as simple as that, in essence

Of course it is ; the banks are no more than Government sub-contractors licensed to create money . This is the moment to come clean once and for all and say that all money is made up out of nothing and it’s only purpose is to enable us to buy stuff , whatever it may be . Right now , in the midst of this pandemic that’s all anyone needs to know ‘ can I buy stuff ‘ . Richard Branson’s £3 billion or whatever it is he’s supposedly ‘ worth ‘ is meaningless right now . This pandemic is showing us- everyone – what’s really going on, but you’ve got take off your blinkers aka your preconceptions about your wages, your pension , your savings et al to get it. Give it another two weeks ; this penny is going to drop like a ten ton weight.

I said it on here yesterday; we already have a quasi national bank , RBS . We still own 62% of it . The government could pass, on Monday, under Emergency Powers legislation , a single clause Act taking over RBS completely. We’re the majority shareholder by a mile, right now for goodness sake ! It could make every adult person in the country an account holder by way of the NI number . They don’t have to use it if they don’t want to. But otherwise how are they going to deal with all the unbanked who are now locked down especially the elderly who are most at risk of the virus.

Where are all the computer whizz kids when we need them. BBC radio has its presenters presenting their programmes from their homes and they sound exactly the same . Time to get real about money, its creation , distribution and spending.

If only we would….

Yep it is that simple, why it needs to be dressed up as MMT god only knows.

Because that is MMT

It is really simple

And radical

Because that is MMT, It is really simple..And radical

It’s simple but what’s radical? It’s Keynes. Fiscal expansion through printing. Boom, bust again. Nothing new

Then you have not understood Keynes

This is Post-Keynesian for a reason….

QE does not cancel debt. It merely postpones it. To claim debt is cancelled is factually incorrect. QE is aimed at maintaining low interest rates, not the direct financing of government. QE is very different from monetary financing, but you are claiming they are analogous.

QE is an asset swap, of long term debt for short term, in the form of cash. QE does not, as some people claim, simply print money for governments to spend. It works by reducing long term interest rates, increasing the propensity for credit extension. The cash that QE injects into the system is also sterilized. The central bank pays interest on the reserve deposits. Yet another reason QE is not cost free.

You make another incorrect assumption that government and central banks are one and the same thing, when they are not in most major economies. Regardless, the central bank is still exposed to the risk of the bonds bought by QE, which sits on their books.

Importantly, when bonds bought by QE mature, the government must pay to redeem them. It can do this one of two ways.

Firstly, it can reverse QE. This requires the government to pay upfront for the bond redemption, reducing the money supply.

Secondly, it could issue new bonds to generate the finance needed to repay the bond. QE has not been reduced in this case, but the new bond must be financed in the normal manner, from government revenues. this is known as rolling the maturity.

In either case, no debt is cancelled and the ultimate cost of issuing the debt still falls on to government revenues and consequently, the taxpayer.

You are claiming that QE creates new, cost free money for governments to spend. Apart from the foolish notion that you can create value from thin air, it is deeply misleading. At best you can claim that the cost of debt under QE will be pushed into the future. The cost to government and taxpayers of raising that debt is still ultimately present.

Now, you might argue that this increased spending is warranted given the situation. It almost certainly makes sense to borrow now at low rates to avert more economic damage, but you must be quite clear that even if QE is used to maintain low interest rates and ease the path of issuance, that issuance must still be paid for over time.

To make it clear, any debt issued, whether purchased by the central bank or not, will eventually need to be redeemed at cost to government and thus the taxpayer. Making claims as you have done implicitly leads to the argument that governments can always use QE to spend as much as they see fit with no limitation, and no cost to taxpayers. While this might prove popular with certain voters, it is a misleading and disingenuous claim. it is simply not true.

On a related note, many governments have their debt currently trading at negative yields. At this point, QE simply becomes unnecessary, highlighting the purpose of QE – which is to reduce long term rates, not allow a government to issue debt ad infinitum.

Issuing debt at negative yields has no cost to government, by definition. As long as that issuance is taken up by investors, QE is rendered obsolete.

JJN

I am afraid to say that you are very wrong.

You are putting out the Bank of England line from 2010, and that was nonsense then (as I pointed out the time) and is nonsense now.

QE did, as it was initially intended to, reduce interest rates: I agree. But it rather rapidly did something else – because interest rates had crashed long before most QE was issued. What it actually did was provide liquidity to the economy that it was missing. The interest rate myth disappeared – precisely because the need for increased central reserves to ensure inter-bank liquidity shattered it anyway: they became the control mechanism.

And the myth that QE will ever be unwound disappeared from view a very long time ago. No one seriously believes that now.

Nor, I suspect, do you, because what you have to say about redemption is absurd if you just think about it. Of course QE gilts are redeemed. The Treasury pays the BoE using a Bank of England account and the Bank then uses that money to buy some new gilts, which the Treasury may well have just issued. The money goes nowhere. That’s not redemption, that’s the perpetuation of what has actually happened, which is monetisation.

Money is, of course, created costlessly: albeit there is always a debt (in the case of government created money rather notionally between the BoE and Treasury, cancelled out on consolidation, of course). But no one says this is value because money is not value. And not a sole with any sense this can be done ad infinitum – and no one in MMT does. Inflation matters.

I suggest you open your eyes to the real world, get out of the text books and observe that is happening. You might learn a lot.

Richard

You are partly correct when you say that interest rates crashed before QE. This had a number of drivers, including market perception of growth and inflation expectations. However, QE was a large driver of this. Central Banks telegraphed that they would be buying large amounts of bonds over and extended period of time, and the markets reacted to this by simply repricing bonds lower. In that much, one could easily say QE did it’s job before it even started in earnest.

You are also partly correct in claiming QE provided liquidity to the economy. In the initial aftermath of the Lehman collapse liquidity was needed. Within a few months though, interbank money market liquidity was back to roughly normal levels. This was partly due to central banks massively increasing their short term and FX lending capabilities. If anything, the combination of QE (which force banks to sell bonds) and Basel 3 regulations (which force banks to hold more government bonds) had a negative effect on interbank liquidity, and caused more of a reliance on the FED window. Where you are more accurate is that liquidity was provided to the rest of the economy thanks to the indirect effects of QE – lower extant rates, lower credit spreads and people switching from government bonds into higher yielding assets. It is important to note that this increase in liquidity was not because of the cash injection from QE.

Whether or not you believe that QE will be unwound (and the likelihood is they will, given the FED had already started and the BoE discussed planned the unwind in 2018, to start 2020) is immaterial to my main point. As we have seen central bank balance sheets were being slowly reduced, but even maintaining QE at stable levels means taxpayers will eventually be on the hook for the cost, at redemption of those bonds. You also ignore the potentially significant cost of QE itself. Central banks still have to pay interest on reserve deposits, whilst wearing the significant risk of owning so much government debt at extremely low yields.

QE is not monetization. In basic terms, QE swaps assets from bonds to cash. Monetization implies creating new money without a corresponding liability. Cancelling the debt, as you call it, without cancelling the money created when issuing that debt.

That all being said, I think you are avoiding the main point. You are claiming that running large deficits is possible at zero cost to the taxpayer, thanks to QE. I feel you are deliberately conflating the issue with monetization, when the truth is that QE merely delays the inevitable pain to the taxpayer. Monetization would do as you claim, but there would be a host of potentially serious, negative side effects such as inflation, as you have mentioned.

You are implicitly say, by promoting the idea of monetization, that this newly created money does have an intrinsic value. If not, there would simply be no point in monetizing the debt in the first place! You actually, in as many words, that the government can borrow, spend and then never have to pay for it, and never have to pass those costs on. This is the unrealistic “free lunch” claim. It also highlights the difference between monetary financing of deficits and traditional debt financing, with or without QE. If QE were truly monetary financing, as you claim, you would see that appear in pass through data such as money supply and nominal GDP. That you don’t acts as hard evidence of the distinction between MF and QE.

It is this sort of vagueness that misleads people, treating the two as the same, but not quite. Especially when you outwardly present yourself to the uninitiated as an expert.

I am trying to put things in quite simple terms here for your readers, but I can assure you I have a sufficient amount of real world experience in dealing with exactly this subject.

I rather doubt your last claim

Taxpayers are never on the hook for QE redemption: it can be, and always will be rolled over (as has been true for 98% of all done, and all outside the US, I think). So this claim is nonsnese number 1.

Nonsense number 2 is that central banks have to pay interest on reserve deposits: no they don’t. They do. But they don’t have to.

Nonsense 3 is your claim QE that never reverses is not monetisation. It is.

And QE will never give pain – as is glaringly obvious. Why is money so painful?

Let’s be blunt here: you’re simply wrong. There is no beating around that. So please don’t waste my readers time again

I’ll make an exception if you can show precisely how despite perpetual repetition of rollover the supposed ‘taxpayer’ can pick up the cost for QE

Not bullshit: full double entry to be explained with a debit in the expense account of the ‘taxpayer’ at the end

I’m curious to see how you do that….

Doubt it or not, experience of the matter comes first hand.

As for your points. I will answer both of your posts in one of my own and attempt to answer in some form of logical order. This will undoubtably be a long post, given the complexity of the subject.

The idea that QE will never be reversed and exist in perpetuity is trying to create a straw man argument. As we have seen, QE can and has been reversed. Regardless, even when debt is rolled over within QE there are various mechanisms which transmit a cost onto government budgets.

The first is that central banks do have to pay interest on reserve deposits, unless the base rate is 0%. This target rate, be it FED funds or the BoE base rate acts as the target for all other forms of interest rate transaction, commonly known as open market operations. It is the most important and often only tool a central bank has to control rates, by lending or borrowing until the target short term rate is achieved. This of course directly affects the money supply.

One could almost think of QE as a similar operation, albeit acting on long term rates rather than a specific short term rate.

QE that never reverses, itself a very poor assumption, still bears costs. There is still an asset with a balancing liability on the other side. All you have done by claiming the QE will never be unwound is extend the reckoning out into the future, whilst valuing the cash asset created at par.

It is a neat sleight of hand I often see used in this argument, but it does not hold water. You still have the debt liability on one side, which has certain inherent characteristics — more of which later. Monetization simply does away with the liability entirely. At which point a government may as well also do away with the charade of QE.

Now let us look at the costs of QE policy, over and above the costs of simple redemption and reversal.

You are asking for it in terms of double entry bookkeeping. This is an overly simplistic manner of examining the issue, and will lead to incorrect conclusions. This basic double entry method you are proposing ignores everything bar the par value of the bond at issue and redemption, which no doubt you set to 100. In practice this is simply not good enough, as we will see.

The first mechanism costs are directly transmitted we have already mentioned. Central banks pay interest on excess reserves to maintain their target rate or rates. The downside of increased liquidity/ money supply is central banks have to mop up more cash to maintain this rate. It is not the major cost of QE, but it is appreciable when the Overnight depo rate is 0.1% and the 10y bond is trading at a yield of only 0.36%.

The second mechanism is slightly more complex, and is where your basic bookkeeping methodology starts to collapse. When a new bond is issued, treasuries tend to try and issue them at or near par. In practice, this means the bond coupon is similar to the extant bond yield in the secondary market. On redemption, bonds also redeem at par. So far, so good for bookkeeping. The new bond issued to roll QE is issued at 100, whilst the old bond redeems at 100.

Unfortunately for your double entry, it forgets about the bond coupons. In practice, all bonds have a final coupon, and it is important.

Let us take the example of the current on the run 10y Gilt. It has a coupon of 4.75%. For simplicity, et’ call it 5%. Let us also assume that when it matures, 10y rates are sitting at 1%. The bond has a bullet repayment at par, of £100m. The new bond issued is also at par, with coupon and yield of 1%. The two net off. Again, so far, so good.

We are forgetting though the last coupon on the old bond. It is a 5% coupon, paid semi-annually. This means that there is a final coupon of £2.5m to be paid by the government to the central bank. Government still has to find that from somewhere — in short, the taxpayer. You might argue that government could simply issue £102.5m of the new bond, but that would entail an increase in QE, given QE is set by face value not price.

This mechanism costs government around 1-2% of the extant amount of QE. It will vary over time, depending on the path of rates over that same time, but it is very real. Whilst again not a huge amount, it is a direct cost, payable ultimately by taxpayers.

Now you might say, but what happens if rates are higher than 5% when the old bonds redeem? Wouldn’t the government actually make money in this case? You would be correct. The money made in this way would unfortunately be swamped by the losses from the third main mechanism the passes QE costs back to government and the taxpayer.

Bonds, even government bonds, carry risk in various forms. The important form of risk in this case is interest rate risk. Default risk is negligible and for simplicity we will ignore convexity. As market interest rates change, the value of a bond will change. This is known as PV01, or price value of a basis point (0.01%).

Again, let us take an example. The 10y Gilt currently yields 0.36%, and it’s PV01 is roughly £1000. This means that if you own £100m of those bonds and the yield moves 0.01% higher to 0.37%, you will lose £100,000.

To put this into perspective, the BoE (will) own £645bn, with an average maturity a little over 10 years. That means should interest rates move 0.01% higher, the BoE suffers a loss of £645m.

I hope it is not inconceivable to you that long terms rates are eventually likely to rise, given there is an effective floor at some level. Indeed, central banks have at times made a profit by the very same mechanism as rates have continued to fall. This windfall has already been mostly bee transferred back to national treasuries and used, so there is no safety net other than government bailing out their central banks once rates start to rise gain. Which in time they are likely to.

This is something central banks fear terribly, noting the experience of Japan in particular. Unless you are suggesting infinite QE, with central banks supressing rates in perpetuity, it is a problem that one day will need to be dealt with, and is the main reason central banks are so keen to wind down their balance sheets when possible. It is a problem that simply cannot be overcome other than by reversing QE. In your words, QE could cause a lot of pain. Enormous amounts. QE is not just money, as I have been trying to say all along.

I am sure at this point you will argue that either interest rates will never go up, which is an assumption of risk you simply can’t make, or that QE can be increased in perpetuity to maintain interest rates at current near zero levels. This would remove the ability of the central bank, acting through market prices to control the money supply and interest rates, almost inevitably leading to inflation and asset bubbles. In general, a terrible idea.

These are the main, direct costs to the government, and through them the taxpayer of QE. At the moment they are manageable, and more likely than not better than the alternative of not doing QE. That does not mean though that there is no cost. Even now it is not negligible, and that is before we take into account the costs of finally redeeming and reversing QE.

There are also a lot of indirect costs to QE. Specifically, pensions come to mind. With bonds offering a negative real rate of return, many pension funds have been badly hurt when compared to their liabilities. DB funds are in terrible shape as yields have been forced so low, and government and the taxpayer will be forced to step in and make some whole, accounting for it’s own massive and unfunded liabilities. I could go on but I hope you now get the picture.

QE is a judgement call, but it most certainly is not cost and risk free, as you are making it out to be. Future generations will be forced to pick up the cost at some point, exactly in the same way normal debt issuance would mean the same.

Which is why I suggested that with bonds already yielding so little, and negative in some states, there is little (or indeed nothing) that more QE would achieve in terms of financial support that increased deficit spending would not, especially if central banks maintain short term liquidity in the money markets through other means (for example, the ECB’s LTRO). The only caveat to that would be if interest rates and credit spreads start to rise significantly through market stress rather than recovery.

This touches on the point made by Paul Hunt. The ECB, FED and BoE certainly would intervene if markets forced rates and spreads higher, as I have mentioned. They would only do this through the secondary market though. The FED and ECB are by law not allowed to access the primary market, and nor would they want to. QE has the greatest effect (there has been a lot of academic work on this) when acting on the secondary market — price information is disseminated more quickly.

To sum up. QE has a real cost to the taxpayer. It merely delays the day of reckoning, whilst adding significant risk. It is a judgement call made that those long term risks are worth taking given the near term outlook for the economy. To say though, that QE is free, riskless and costless is deeply misleading, as well as being factually incorrect. Oversimplification of the problem has led you and others to this conclusion, otherwise known as the “free lunch” solution. There is no such thing. It is frivolous to think so.

You yourself seem a touch confused on the point. On the one hand you correctly state money is not value, then argue that more free money would create value. It is an odd dichotomy, and one I think often stems from a political viewpoint more than an economic one.

I have only touched on the complexity of the problems of QE, but I hope I have covered the subject in enough detail to clarify the problems it brings with it.

I am sorry 0 but you base your argument on false premises

1) QE will be reversed. There is not the slightest evidence it will be, and only the US has tried to do so, and then in exceptional circumstances that are very unlikely to be repeated. Most of your argukwents faila sa result.

2) Governments must pay interest on central reserves. No they need not: it is entirely up to them.

3) Interest rates will rise. No they won’t: more QE will stop it if there is any risk that is true.

4) Central bank rules and laws will remain unchanged, which is now not true, by a very long way.

Those four simple statements of fact end all your arguments.

You make another extraordinary claim though, which is that money is not value. Of course it is not: no one said it was. But credit has enormous value and since all money is credit you reveal you really do not understand some very basic issues with that claim.

But you are right on two points:

a) With interest rates at zero we no longer need the charade of QE. That is why we will have direct money funding instead.

b) This causes problems for pensions. That is true: but the problem is much bigger. read what I have written on the fundamental pension contract: search this blog and you will find it.

You miss the last important one: QE will be replaced in due course with direct money funding. All the problems you suggest disappear, even if your incorrect assumptions were true.

I am sorry, but this is not an argument worth perpetuating: you are arguing on the basis of the BC (before coronavirus) consensus and we are moving to a Post-Coronavirus Consensus: it will be very different. Please move on.

I am honestly taken aback by what you have written. I spent time answering your question as to how QE eventually burdens taxpayers with cost, and you haven’t bothered to address the points I have made.

Instead you have simply repeated the fallacious and incorrect arguments you already made. For your guide, simply repeating yourself doesn’t make you any more right. I get the impression that you see the world as you want to see it, rather than how it actually is.

To address the points you make:

1. There is plenty of evidence. The FED had started the process. The BoE agreed an action to reverse QE, but held off due to the uncertainties surrounding Brexit. The exceptional circumstances you speak of? Economies that were growing, with low unemployment. Unless you are claiming that will never happen again, then at some point central banks will have to take action to cool growth.

Nor does this affect one of my basic points. Central banks holding bonds under QE face the prospect of massive losses when rates rise. These would have to be covered by government, and ultimately the taxpayer.

2. This is simply incorrect, and betrays a lack of understanding of the functioning of a central bank on your part. Paying interest on short term deposits is the primary manner a central bank controls short term rates and the money supply. What do you think would happen if there were excess reserves in the financial system, with nowhere for them to be placed?

3. This is your straw man argument again. You are essentially claiming that long term interest rates will never rise ever again. This is absurd.

Not only is this in itself ridiculous, the idea that ever increasing amounts of QE to cap interests rates ad infinitum would create a problem worse than the cure. By doing so, you remove the ability of a central bank to adjust rates to control inflation, whilst at the very same time increasing the money supply. Which by definition would put upwards pressure on inflation. Combine that with point 2. above, where you claim that central banks don’t have to pay interest on reserve deposits, and you remove any sterilization of this new money supply.

That money would be forced to chase higher yielding assets, and create speculative bubbles. Again the likely effect would be to increase inflationary pressure. All the time, you are storing up more damage to the central bank and more potential losses for when rates do eventually and inevitably rise.

4. The FED and ECB are by law not allowed to finance government directly. The BoE just thinks it is a terrible idea, having looked at and rejected the idea.

The laws are as they are. If they change then we can discuss the resulting implications, but you are trying to make your case using your own version of the facts, not the law as it stands in the real world.

Let us move on to your other points.

You once again get confused when talking about value, money and credit. Your argument seems to follow this logic:

Money has no intrinsic value.

Credit does have value.

Money is credit.

Money has value!

I suppose if you use totally circular arguments like that, missing out any real understanding then you can prove anything.

I agree that governments can create money out of thin air. That does not create value. Your whole premise is based on the idea that this newly created money has value, which the government can spend to increase the size of the economy, and importantly this has no cost and no risk.

Moving on.

a) No, we will not have direct monetary financing. As I have said before, the FED and ECB can’t by law, and the BoE won’t.

Nor have you answered why it is even necessary, when a government can borrow so cheaply and avoid all the serious implications of resorting to monetization.

b) I am not sure what you have written on pensions, but whatever that may be you find it hard to square it with what you have written above. Saying that interest rates should be zero forever, implying significant negative real yields and returns would force all pensions out of government bonds and into higher yielding, riskier asset classes.

To finish. Let us take a look at what an economy run by your rules would look like.

Government would finance itself through monetization. This would drastically increase the money supply, weaken the currency and cause investors to lose faith in the value of their investments. Long term interest rates would rise to compensate for the increased risks, uncertainty and increasing inflation expectations.

You would then send in the central bank to do yet more QE, to force rates lower. Once again increasing the money supply and sending real rates into highly negative territory. This would make owning government debt a very poor investment, forcing the government into yet more monetization and QE to pick up the slack where private investors have fled the market.

Now, at this point you have an economy with zero rates, massively expansionary fiscal policy and a large increase in the money supply. All of which tend to be inflationary if left unchecked.

What do you next propose. Of course! You remove the main tool a central bank uses to sterilize and control the money supply, saying they don’t need to pay interest on deposits. What do you think people are going to do with all this spare cash they have lying around, knowing that the government is printing more of it al the time and inflation is going higher because of it. Nothing? Any sensible investor will look for assets generating a real rate of return. Given there will be ever more cash chasing the same pool of assets, less the now useless bond market, you are directly promoting asset bubbles.

So now we have a government unable to finance itself through the bond markets, and instead has to resort to monetization. We have inflation with no means of controlling it, and we have an ever increasing money supply creating asset bubbles and instability, all while the currency weakens.

You are literally suggesting the tried and tested methods for economic instability, which almost always leads to disaster. The very reasons central banks operate in the manner they do is to prevent this scenario, yet here you are suggesting that we should throw all that hard earned experience away, and return to policies which not only court trouble, they act together and in concert to encourage it.

I truly find it unbelievable.

I find your argument as unbelievable as you apparently find mine

But what I really find strange is that you don’t even believe in your won arguments. Dor example, you say interest needs to be paid on central bank reserves, and yet the goal of governments now and for a very long time to come is zero net interest. So the reality is that interest won’t be paid. And if it was required, QE would be used to cancel the need.

You hand everything on a tiny Fed unwinding.

Exceptions don’t prove rules.

But what is apparent is that you want the old rules to re-emerge. I dont: not for one minute. It is those rules that failed us. They may have suited you. But they did not suit 99%. Making upo reasons why we should keep them – as you are – is not reason for keeping them. It is reason for exposing the hollowness of your argument.

I am satisfied that I have done that.

You will always disagree.

C’est la vie.

I am going to respond to another issue you raised, which was this:

You once again get confused when talking about value, money and credit. Your argument seems to follow this logic:

Money has no intrinsic value.

Credit does have value.

Money is credit.

Money has value!

I suppose if you use totally circular arguments like that, missing out any real understanding then you can prove anything.

I agree that governments can create money out of thin air. That does not create value. Your whole premise is based on the idea that this newly created money has value, which the government can spend to increase the size of the economy, and importantly this has no cost and no risk.

You wholly missed my point.

I say money has no value.

But I say that that credit permits has value.

And making settlement delivers value

Money creates value in use

That’s why when it does not exist it needs to be created

You seem quite unable to link and argument to the real economy, which is precisely what I am doing and you are not

Making things up doesn’t make them facts.You hav made claims which are simply not accurate when compared to the world as it currently exists.

For example, central banks do pay interest on reserve deposits. BoE at 0.1%, FED funds, etc.

Nor do government have a goal of keeping interest rates low. It is a necessity born of the current situation and economic climate. If anything, most are trying to create the economic conditions to encourage growth, for rates to normalise, deficits to decline and debt levels to reduce. Most governments are also acutely aware of the inherent risks of long term zero interest rate policies.

You, on the other hand, are seeking to promote such policy rather than as a measure to deal with economic crisis, but as an every day long term goal. In doing so you are making fallacious statements – such as claiming debt is being monetized and the cost and risk of doing so is zero. I am not sure if you are blind to the risks involved, but you seem to live in a world where no trade-offs exist and there is no uncertainty.

If you want to talk about exceptions, one would have to say that QE is the exception itself. It is a new tool of monetary policy, which poses significant question as to it’s efficiency and the long term effects.

Nor is it about me “wanting” the old rules to emerge. It is about what works nd what doesn’t and what is likely to secure the best and most stable long term results. Your answer, it seems, to everything is simply to have the government print more money. Believe it or not, that is itself a very old game, tried many times over. All resulting in terrible economic damage.

I still wonder though why, when you ask me to describe the costs associated with QE, which I did in some detail, you suddenly veered away from the topic and back to what amounts to little more than rhetoric. Which I also then covered, pointing out that your suggestions would encourage all the required circumstances for economic instability. You seemed to be unable to argue your point there either, other than just asserting you are right, and throwing petty insults in my direction. It is almost as if you haven’t really thought through what you are saying, or realised that you are not the first to have such ideas or even put them into practice.

It’s almost as if you live in a vacuum, where no-one else has any real knowledge or experience, yet in your splendid isolation you are able to come up with all new, infallible ideas in record time.

This is getting tedious

Read this by Jim McCormick in the FT this morning https://www.ft.com/content/4d2711c9-c373-4038-a2cd-b0fd41a9bcc1

Zero is here to stay

Money creation will be the new normal, he says

And laws can be changed (even if you thought you’d succeeded in embedding neoliberalism forever using them)

And no, I do not think money creation is the answer to all problems. I think it is until full employment is reached. And I care about people first and foremost. And only then do I worry about inflation.

There has been economic instability – created entirely by the systems you advocate, which have failed us all

We will move on. You and your City friends will not like it: bad luck. Your day is over.

What MMT proves is that you are not the masters. And that’s what you really do not like.

Now stop wasting my time

@JJN,

You make many valid points, but at the very end you introduce a proviso: “As long as that issuance [of government bonds] is taken up by investors…”. If bond market participants force a rapid widening of spreads it appears that the dominant western central banks, the Fed, BoE and the ECB, are prepared to countenance direct monetary financing – by participating in the primary market.

This piece by Philip Lane, the ECB chief economist:

https://www.ecb.europa.eu/press/blog/date/2020/html/ecb.blog200313~9e783ea567.en.html

is enlightening.

Precisely

The bond markets are neutered now

I am quite amused

I think, Richard, you may be being a tad harsh on JJN. I know you are afflicted by right-wing trolls on this site, but there are occasional commenters who convey the impression of having some knowledge and competence and who, while not, perhaps, being compatible interlocuters, deserve a hearing.

Part of the problem is the imprecision of the terminology used. And there are faults on both sides. For example, MMT is not really modern – it describes very simply how money is created by sovereign authorities and this has been happening for a very long tim; it is not really monetary – it addressed stocks, flows, balances and prices across all sectors of the economy; and it is not really a theory – it provides a reasonably structured description of how the economy functions and often layers this description with prescriptions about the economy should function.

On the other side, the defenders of the status quo (or the Conventional Assignment on monetary and fiscal policy – as Simon Wren-Lewis puts it) go to great pains to differentiate between the QE implemented in the aftermath of the GFC and direct monetary financing (DMF). It may be that all of the QE will be unwound eventually; the US Fed tentatively began the process prior to the onset of Covid-19, but it is being reversed at a rate of knots and the Fed is now committed to unleash a wall of money. I have seen no evidence of unwinding in other jurisdictions.

“If it walks like a duck and quacks like a duck.etc..”. But defenders of the status quo maintain it isn’t. It is a convenient fiction. And they are absolutely determined to ensure that any DMF pursued during this pandemic has validity and effectiveness only in the context of this crisis; they will continue to deny its relevance and effectiveness in any other context. If they don’t, the entire edifice they have assembled that benefits the wealthy and powerful (and feeds armies of well-heeled professional functionaries) at the expense of everyone else will crumble. For them, it is a far, far more appalling vista than the one Lord Denning envisaged.

All your comments are fair Paul

You seem as big a critic of JJN as me then….

Thank you, Richard. I realise that you are time-pressed when you are trying to cover so many angles, but I would politely suggest that commenters such as JJN might be treated a little less aggressively; there is evidence of knowledge, thought and time being deployed and expended. Like Jesus and the poor the trolls will be with us always, but generally constructive, if critical, engagement from the defenders of the status quo is relatively rare here.

I generally find that defenders of the status quo, confident in the power and resources they enjoy, rarely bother to engage with any critique. They prefer to ignore it and carry on. And they are content that there are enough attack-dog trolls out there to generate mayhem. But I believe any willingness to engage constructively should be encouraged, as it might convey an unease that, when this crisis subsides, things will not be the same as they were .

And we will all have a role to play a part in crafting this new dispensation.

But he was uttering nonsense

And speaking truth to power is about saying so

JJN

As soon as you mentioned that the taxpayer has to pay the debt, for me, you’ve blown it.

This is Government arranged money we are talking about and it has nothing to do with the taxpayer, nor does it need taxes to rise to pay for it. You are forgetting/not taking into consideration that the expansion of an economy due to a bond created cash injection alone will lead to an increase of tax volume which will then be packaged up as benefits for example and spent back out into the economy. Tax will not be needed to pay down any debt – delayed or not. Tax revenue may be need to pay interest on the bonds – but if the bond redemption is kept between the Government/Treasury/BoE the cost can be kept low.

Even if what you say is true, we are living it a time of historically low interest rates which means that even if the bonds had to be sold on open market operations, yields would be manageable so the day of reckoning as you call it is not as risky as you make out unless of course the market does it usual dirty tricks and makes the interest on the bonds artificially high (as it has done in the Euro zone as Spanish and Greek bonds will testify). The Treasury and the BoE know this sort of thing goes on, which is why it makes sense for the Government, Treasury and BoE to arrange for bonds to use the auto-financing model because all the private bond markets are trying to do is muscle in on fiscal policy for profit.

What I find troubling about your attitude JJN is that you seem to completely ignore the fact that a democratically elected British Government is sovereign and owns the currency – the pound. It is not owned by ‘the market’. Your stance seems to say that the Government has no power whatsoever in these matters. Basically you are a financial anarchist who just cannot accept that Government has such power to create money in the way MMT prescribes because you feel threatened by it. Your comments – for all their appearance of reasonableness – reek of anti-Statism and pro-market dominancy. You fear what Henry Ford said – that if voters found out how banks made money, there would be revolution overnight – don’t you?

As for Paul Hunt – I appreciate the effort to bring people together but you must understand that the people behind the thinking of the likes of JJN will always want more, even though they already have everything.

This debate about MMT is not actually about money Paul – it’s about POWER. Who governs Britain? Think of it like that is my recommendation.

Thanks PSR

QE does not reduce total government debt to the private sector. The central bank buys gilts by creating reserves. Reserves are a debt to the private sector, no different from gilts. The difference is the terms, no maturity and at lower rates. That is why debt never came down during the previous period of QE

The ultimate problem remains that in an open economy where so much is imported, we need to convince non residents to hold our debt. So if we control interest rates, then the expression of non residents unwillingness to fund the government becomes the currency.

I am sorry to say that you are very wrong Ian

If central reserves are held without a maturity date and without interest they are…..money

And that central reserve is then simply a current account – subject to significant restrictions on use

And of course, all cash (note and coin) is part of the national debt

If there’s any part of it you don’t want please send it my way

And we have not the slightest problem in persuading people to hold our debt – precisely because we can never default on it which makes it so valuable

And anyway, as a matter of fact, we have the longest dated debt in the world and a quite small foreign ownership

Easiest to think of it this way a mixed economy (is there anything else possible?) runs on a mixture of social and market money (medium of exchange) creation. Now that the coronavirus pandemic has undermined market creation of money the government has to step in to support the market part of the economy.

Contrary to majority understanding the government through its central bank can create money (medium of exchange) directly. It’s only been citizens (who’ve been mislead by selfish individuals) who think a government needs to issue treasury bonds to fund its spending. In practice even with treasury bonds the central bank has the power to create money to buy as much or as little of government bonds as the government sees fit.

Sort of….

I would argue that all money creation is by government, but banks do it under licence from them

You’re absolutely right that bank money creation is now drying up so government has to take over though – I agree with that

As you quoted JKG the other day, …so simple the mind is repelled…. Lets hope the Treasury deficit police aren’t repelled by the sight of that graph and the realisation that it will probably be much larger.

Indeed

There’s still a massive job to do in educating the media. People on the BBC for instance, in all sorts of programmes, still trot out the phrase ‘tax payers money’ all the time. Maggie Thatchers household budget analogy is deeply embedded.

Even, or perhaps most especially, with Peston – who the rest think knows what he’s talking about when on this issue he is utterly clueless

Let’s boil this conversation down to its fundamental state : the amount of money in circulation has to be ( roughly ) equivalent to the goods and services in production in order to prevent inflation. But there is no direct control over this. Added to which a vast amount of consumer goods available in the UK ( and everywhere in the West ) are imported cheaply from China ; and then marked up massively – so the distortions of ‘ free market capitalism ‘ extrapolated to a global level are incalculable. The virus has put all of this in jeopardy and we have no idea how this will play over the next six months, let alone any longer timeframe.

I don’t think your description is really correct – money currently in circulation represents /potential/ purchasing power, but inflation is driven by /actual/ purchasing decisions and desires. This is why the quantity theory of money is bunk – money sitting in someone’s bank account isn’t inflationary, it’s only when that money is actually applied to the purpose of gaining access to real goods that it has potential to be inflationary.

Richard i hope you are well i am astonished at the amount of output you are putting on this blog, plus other activities even though you are not well. I thought you were going to scale back?

There is a lot of stuff i do not understand about economics, especially when it comes to local taxes and their uses in the local economy. Where does council tax and council tax spending/funding come into play? Randall Wray says local state governments need their local taxes to pay for services, though i am not sure if the states get federal government funding for the operation of state governments. (i have to ask him about this). I am sure the states in the US, get funding for federal activities within the state, ie federal institutions both civilian and military.

In the UK, the govt funds both the welsh, scottish and northern ireland assemblies.

So my question is – even though the UK government funds national/local government with a lump sum, do councils need council tax to fill the funding gap? Or do councils send council tax payments to the central government and the treasury sends back the required amounts? So as consequence of this funding structure the amount shrinks every year, so it requires cuts and more council tax rises. I do know all councils get direct govt funding but not sure what the role council tax plays in this. If council tax does pay for services than it puts holes in the notion that tax or obeit a certain kind of tax does not pay for services. I do know income and national insurance contributions do not pay for government services ie the NHS, the military, governmental operations etc. Also i do know the government can never run of currency, cash, never be able to – not pay its debts and all money creation is debt/ credit a the same time. I also do agree that a government can never be in debt in its own currency as it owns its the currency and thus the debt is nullified.

On a side note, it seems no matter what Boris Johnson does, no matter his incompetence and the mess he is making of the covid 19 crisis, his approval rating is sky high. It was 72% at the last count, so why are the polls showing this high approval rating? Why is the public believing he is doing a good job, where as any one who has been looking closely at his performance knows clearly he has made right pig’s ear of the crisis.

My view is we are in an age of great ignorance and the experts are totally ignored. The people just go to charletons for simple answers and solutions.

I have no answer as to why Johnson is doing so well

I have a very strong suspicion it will change, radically

Chamberlain was probably doing well in February 1940

Richard . He’s doing well because he’s all we’ve got and now he’s got the virus. What matters now is getting the tests out to everyone asap . South Korea is the model . My son told his brother-in -law who’s an MP, two weeks ago, SK was the model and he was told ‘ There are smarter people than you and your neighbour working on this and we’ve got nothing to learn from other countries ‘ . Maybe now that Johnson has the virus he will get it ; ‘ it ‘ being reality . Reality being whatever it was you thought about what was ‘ true/ false ‘ , ‘ real / unreal ‘ , ‘ known / unknown ‘ changes by the day . I appreciate very much that you have made this space available for us to comment like this, but as I said on here a couple of days ago I am 70 plus and have experienced nothing like this in my lifetime. Any comments I have made about money on here are dwarfed by the reality of what we face as humanity .

I agree…

Entirely

What is about to happen is horrendous

I only talk about what happens next because I care forthe survivors too

Here’s an analysis that made sense to me

https://humanfutures.substack.com/p/confidence-men-johnson-and-trumps

Basically as suggested a “common enemy” has a rallying effect in the early stages regardless of leader

The FT figure does look like a huge under-estimate. At a rough estimate, tax receipts for a quarter will go into reverse, so instead of roughly £150bn in, £150bn will go out, and for the following quarter probably net nil, so that makes probably a £450bn hole in government revenue.

If anything good might come out of all this, possibly it’s that the penny will drop for a lot of people. When we find we’re not living in Zimbabwe or the Weimar Republic, and not carrying our wages home in wheelbarrows, or driving them home in Transit vans; perhaps then all the neolib apologists might be forced to admit the truth of what you’ve been telling us here. So there may be some small mercy in this happening under a Tory government…

There will be receipts this quarter – people are still working

There are sales

But those receipts will be way down

I cant help thinking this ‘deficit’…. is going to be a good deficit.

public sector deficits, are private sector surpluses. However, this time, rather than the money going to rich corps, the money is going to people. They are being paid by the government, and since they are unable to spend it on anything but the necessities, they use the remainder to pay down debt, or save it. They’ll also put off getting loans, so the stimulus of private bank credit will dry up, the government having to step in to keep the economy ticking over.

Result, debts for the man on the street come down – its a transfer of debt from the poorest, to the government.

Of course, once things are back to normal (if they ever get back to normal), the tories will use the huge deficit figure to reverse this trend with huge tax rises with the claim of ‘no alternative’.

I fear personal debt is going to rise, significantly

What proportion of all money in circulation is government money (spent into existance via BoE) vs bank money (credit created by commercial banks)?

I am trying to get my head around the consequences of bank money drying up and the need for government money to fill the gap.

Extremely hard to prove – they all, literally, look the same in a ledger – which is the only place that they exist

The measure is the net decline in bank credit – and I do not have that figure right now on a Sunday morning, sorry! It is in ONS stats

In FT Personal Finance Justin Urquhart Stewart suggests selling “Corona Bonds”.

Corona QE as I have called it…

Wow. So much to think about.

The obsession, by some, with the national “debt” seems to never really face scrutiny.

Is anyone really suggesting that there should be a concerted effort to pay it off???!!

What is it now? 1.7 trillion, or there abouts?

How does it get payed off?

Has any of it ever been paid of in any significant amount? (I know the debt to GDP ratio can rise and fall, but that isn’t the same as actually decreasing the debt as an actual amount)

In the non MMT world, wouldn’t the government need to run a surplus to pay any of it off?

That would mean (in the non MMT world) government taxing more than it spends in a year and do it for years on end? How many times has the government run a surplus in the last 70 years?

Raising that kind of tax would suck so much money out of the economy. Is that such a good idea???

There is also this strange idea that the debts we run up now will be such a burden on future generations. But if the debt has been there since the creation of the BoE, how come we have not all been crushed by the debts our forefathers racked up already?

Why don’t people just admit that it will NEVER be paid off and it isn’t meant to be!!!!

And if that is the case, can it ever really be seen as a “debt”? A debt that never gets paid off is never a real debt???

Isn’t the debt really just a record of how often the government has spent central bank reserves in the economy and then “retrieved” them via issuing bonds?

The fact that Government has to give private institutions some future reserves in the “retrieval” process is a querk of the system but not crucial.

The reasons for this convoluted “retrieval” process is political not practical. The private banks want to control government money creation and the government wants to control the private money creation. (Those clever private bankers have come up with ways to reduce their need for central bank reserves, and in so doing, weakened the government control over them)

But it doesn’t need to be like this……..

The key point is that the national debt is not debt

It is money on deposit with the government

And at the same time that is the core money supply…

No sane person would want to pay it off

Eevn the Germans are realising that now

I agree.

So why is it even called a “debt”? (I’m not asking you directly Richard by the way! Just putting it out there to me mulled over!)

It’s miss leading at best, dishonest at worst.

I never see a debate in MSM on its nature. Is this deliberate (a conspiracy of silence) or just plain ignorance?

Words have power and THAT word shapes how people conceive the economy, which is abstract by its very nature.

Anyone got a better idea of what it should be called in one word?

This is using language to capture the narrative

JJN.

The whole thing relies on one magic ingredient though.

Never ending exponential GROWTH.

Without it, bonds and interest bearing loans and all the rest of it cease to exist.

But exponential growth is coming up fast against a finite planet.

We need an economy built on sustainability, not a return to what we have already been doing. If money is created through interest bearing loans, then it is no longer fit for purpose.

MMT (without the middle man) shows a way forward.

To continue with the (until a month ago) present system of debt created money, is the road to ruin.

Coronavirus will look like a small blip compared to the economic and social chaos that climate change will bring.

This is the moment for that change.

Just a quick technical question on QE.

Are there always enough bonds out in the “market” for the BoE to purchase or has the Treasury had to issue more bonds so that the BoE can buy them?

Has the “market” been obliged to sell the bonds even if they didn’t want to or are they always happy participants?

If, say a pension fun sells some of their bonds to the BoE, won’t they need to replace them to top up the portfolio?

Technically, probably there are in the UK

But certainly that is an issue in the eurozone where other assets have to be bought instead now

Direct money finance gets round this

Are there enough bonds out there in the secondary market for the the BoE to buy to “raise” all the money (so far!) that the government has pledged to spend?

Or will the Treasury have to create more bonds for this specific purpose?

If so, are the BoE going to buy direct from the Treasury rather than going through the convoluted process via the banks?

Is there any appetite in pension funds to buy more bonds?

Direct monetary financing does not involve banks or secondary markets

It is the BoE lending to the government

And that’s the way I think we will be going